zagoroddom40.ru

Recently Added

How Much Can You Make If Retire At 62

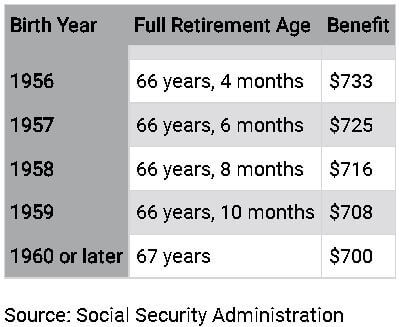

The Social Security earnings limit is $1, per month or $21, per year in for someone who has not reached full retirement age. If you earn more than. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at For the year , the maximum income you can earn after retirement is $22, ($1, per month) without having your benefits reduced. The amount that's exempt. If you have at least 10 years of vesting service, you can receive retirement benefits if you retire on the first of any month on or following your 55th birthday. After reaching full retirement age, there's no limit on how much you can earn while collecting full benefits. Retirement Age and Social Security. Collecting. If you start your Social Security benefits at. Age 62, your benefit will be lower than if you wait until your full retirement age. Most people need 40 credits . If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. In , the average monthly Social Security retirement benefit is an estimated $1, While that regular monthly income helps retirees, it's usually not. The Social Security earnings limit is $1, per month or $21, per year in for someone who has not reached full retirement age. If you earn more than. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at For the year , the maximum income you can earn after retirement is $22, ($1, per month) without having your benefits reduced. The amount that's exempt. If you have at least 10 years of vesting service, you can receive retirement benefits if you retire on the first of any month on or following your 55th birthday. After reaching full retirement age, there's no limit on how much you can earn while collecting full benefits. Retirement Age and Social Security. Collecting. If you start your Social Security benefits at. Age 62, your benefit will be lower than if you wait until your full retirement age. Most people need 40 credits . If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. In , the average monthly Social Security retirement benefit is an estimated $1, While that regular monthly income helps retirees, it's usually not.

Many financial experts say retirees will need 70 percent or more of pre-retirement earnings to live comfortably; therefore, private pensions, savings and. After reaching full retirement age, there's no limit on how much you can earn while collecting full benefits. Retirement Age and Social Security. Collecting. The earliest you can retire is 62, no matter when you were born. The This will happen if you make more than the yearly earnings limits. To learn. For example, if you initially enrolled in the FRS before July 1, , and turn age 62 on May 30, your normal retirement date would be May 1. If you reach your. Estimate your retirement benefits based on when you would begin receiving them (from age 62 to 70); Calculate what payments you would receive based on your. If you reach your full retirement age during , your earned income limit rises to $59, and the benefits reduction becomes one dollar for every three. However, the month you hit your full retirement age, your benefits are no longer reduced, no matter how much you earn. In fact, the SSA will recalculate your. It's dependent on your lifetime income and how much you paid into the SS system. I mostly worked part time and I get $1, My husband always. Timing Benefits. An individual retiring at 66 years and ten months will earn FRA. If they opt to receive benefits at age 62 it will reduce their monthly. You may be eligible to collect Social Security as early as 62, but waiting until age 70 yields greater benefits for most people. Here's help on how to. But, by waiting until age 70, I would lose out on about $K between 62 and Even if I only wait until full retirement age of 67, I would. we determine how much you can expect to receive at your desired retirement age. If you're between age 62 and your full retirement age, and you're. The SSA website provides estimates for how much you'll collect if you start receiving benefits at age 62, your full retirement age (FRA) (between 66 and 67). if you cannot or did not save as much as you would like. When you claim Waiting to claim as long as you can could still make sense for you if you. If you start collecting your benefits at age 65 you could receive approximately $33, per year or $2, per month. This is % of your final year's income. If you have at least 10 years of vesting service, you can receive retirement benefits if you retire on the first of any month on or following your 55th birthday. But, by waiting until age 70, I would lose out on about $K between 62 and Even if I only wait until full retirement age of 67, I would. If you retire at 62, annuities with lifetime income riders can provide extra income along with your Social Security. They pay you regularly for life, adding. you may ask, “How much will I get from Social Security?” To find out, you if you retire at age $______. Year. A. Maximum earnings. B. Actual.

What Are Mortgage Interest Rates At

Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $2, Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 07 pm EST. Mortgage rates as of September 5, ; % · % · % · % ; $1, · $1, · $1, · $1, Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, A mortgage interest rate is the percentage you pay to borrow money for a home loan. Interest rate is part of the annual percentage rate, or APR. If you subtract. A VA loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included; therefore. National year fixed mortgage rates remain stable at %. The current average year fixed mortgage rate remained stable at % on Sunday. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $2, Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 07 pm EST. Mortgage rates as of September 5, ; % · % · % · % ; $1, · $1, · $1, · $1, Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, A mortgage interest rate is the percentage you pay to borrow money for a home loan. Interest rate is part of the annual percentage rate, or APR. If you subtract. A VA loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included; therefore. National year fixed mortgage rates remain stable at %. The current average year fixed mortgage rate remained stable at % on Sunday.

Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage.

View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. Interest costs over 30 years Over 30 years, an interest rate of % costs $, more than an interest rate of %. With the adjustable-rate mortgage. Today's Locked Mortgage Rates ; YR. CONFORMING. % − ; YR. CONFORMING. % ; YR. JUMBO. % − ; YR. FHA. % − Today's loan purchase rates ; InterestSee note%, APRSee note2 %, Points ; InterestSee note1 %, APRSee note2 %, Points Mortgage Rates Remained Flat This Week. September 5, Mortgage rates remained flat this week as markets await the release of the highly anticipated. The national average mortgage rate is %. Find out what your personal rate could be. Check our rates. National average rates. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Customized mortgage rates ; year fixed, % (%), $67 added to closing costs, $2, ; year fixed, % (%), $ credit to closing costs. A mortgage interest rate is the percentage of a home loan amount (principal) charged by a lender for the use of its money. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. For today, Monday, September 09, , the current average interest rate for a year fixed mortgage is %, falling 5 basis points over the last week. If. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Freedom Mortgage personalizes mortgage rates for each individual homebuyer. We consider your personal finances, credit score, and the current mortgage market. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Mortgage Calculators ; 30 Yr. FHA · 30 Yr. Jumbo · 7/6 SOFR ARM ; % · % · % ; · · Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Rates shown reflect current products available with Rocket Mortgage, a provider on our network. year Fixed-Rate Loan: An interest rate of % (% APR). Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term.

Best Bad Credit Business Loans

/cloudfront-us-east-1.images.arcpublishing.com/dmn/VQTVMZKYXBBLVECIAWNZC46WME.jpg)

The term “bad credit” usually refers to a FICO score of – A low FICO Score might be why traditional lenders often reject small business loan financing. I'm a funding specialist that works with a non-bank lender. They provide unsecured working capital to small and medium sized businesses as long as your FICO is. Types of Bad Credit Business Loans. Types of business loans for poor credit offered by alternative lenders include: Short-Term Small Business Loans. A short-. Bad credit business loans from Balboa Capital are helping entrepreneurs like you finally hear a “yes” instead of a “no.”. In need of a California bad credit business loan? You are not alone. Many businesses throughout the country have seen credit taken away by bigger lending. A bad credit score can keep you away from the funds you need for your business. Our Bad Credit Business Loan is a good way to access capital. Whether you need. What's the minimum credit score needed to qualify for a business loan? Applicants with a FICO score as low as may be offered bad credit business loans by. How To Get a Small Business Loan With Bad Credit (In 4 Easy Steps) · 1. Research Business Loans For Poor Credit · 2. Understand Your Lender's Conditions · 3. Can You Get a Small-Business Loan With Bad Credit? Yes, some lenders will issue loans to small-business owners with low credit scores. But there are several. The term “bad credit” usually refers to a FICO score of – A low FICO Score might be why traditional lenders often reject small business loan financing. I'm a funding specialist that works with a non-bank lender. They provide unsecured working capital to small and medium sized businesses as long as your FICO is. Types of Bad Credit Business Loans. Types of business loans for poor credit offered by alternative lenders include: Short-Term Small Business Loans. A short-. Bad credit business loans from Balboa Capital are helping entrepreneurs like you finally hear a “yes” instead of a “no.”. In need of a California bad credit business loan? You are not alone. Many businesses throughout the country have seen credit taken away by bigger lending. A bad credit score can keep you away from the funds you need for your business. Our Bad Credit Business Loan is a good way to access capital. Whether you need. What's the minimum credit score needed to qualify for a business loan? Applicants with a FICO score as low as may be offered bad credit business loans by. How To Get a Small Business Loan With Bad Credit (In 4 Easy Steps) · 1. Research Business Loans For Poor Credit · 2. Understand Your Lender's Conditions · 3. Can You Get a Small-Business Loan With Bad Credit? Yes, some lenders will issue loans to small-business owners with low credit scores. But there are several.

Other options include having a co-signer with good credit or working on credit repair. Remember to explain your situation and compare bad credit business loan. We go to work on your behalf even with poor credit or bad credit. If you have poor credit, trying to find additional capital a low FICO score should not be the. Getting bad credit business loans or a loan for a relatively new business can be difficult, but there are options. Assuming you've already registered your. A Merchant Cash Advance (or Working Capital Advance) is your best chance of getting approved for funding with bad credit. This option only requires a minimum. Low Credit Funding Q&A. How can I get a business loan with bad credit? Direct online lenders are the best place to get a business funding with bad credit. best business loan lenders with low interest rates. Fortunately, there are small business loans for poor credit. Types of Business Loans for Bad Credit. For. Business loans for people with bad credit can be a lifeline in this situation. While this financing may have higher capital costs or interest rates, it allows. Some bad credit small business loans emphasize cash flow and sales volume rather than low credit scores. For example, your borrowing amount for a merchant cash. To execute this might be a different story as it revolves around how well your credit score is and how much difficulty you face if you have a low one. If you. Can You Get a Small-Business Loan With Bad Credit? Yes, some lenders will issue loans to small-business owners with low credit scores. But there are several. Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan. Be a for. Bad Credit Business Loans: What You Need to Know · For every business owner with a low credit score, the notion of a bad credit business loan immediately invokes. One option is bad credit business start-up loans, which are designed specifically to assist new ventures with limited credit history or a low credit score. Below you'll find some resources on how to improve your odds of getting approved for a loan with poor credit. The Basics of Bad Credit Business Loans. Lenders. Business loans can be difficult to secure if you have bad credit. Here are financing options for businesses with poor credit history. Regardless of your low credit scores, our bad credit business loans promise easy application, a quick turnaround, and set repayments. You may prefer not to take. No credit check business loans are possible with alternative lenders like Alpine Credits. Their approval criteria are focused on the equity you have in your. Bad credit business loans can be the perfect solution, and are often the only source of funding that businesses with poor credit can turn to for help. Bad. Read on to find our the best bad credit business loans of June, Have bad credit? Apply for a small business loan with Excel Capital with no to low credit. Explore secured business loans where collateral, such as equipment or property, can mitigate the impact of bad credit.

How To Make Money With $0

Making a profit can take several years when you start a business, so you will initially require the cash from your nine-to-five to make ends meet. Did You Know? Yes, starting your own business is not easy. Even using Internet as the medium, you still need money to buy products at the beginning. However, there are ways. Discover tips for making passive income with minimal capital: affiliate marketing, dropshipping, blogging, and selling digital products. How to make money with $0. - First of all you have to stop being crazy - Educate yourself and start networking - Get a job or start your own. Pouring life energy into making money when you're financially secure makes zero sense: you already have access to all the fulfilling experiences you need . 7. 5 - There are many legit ways to work from home and make money! I had no idea how to earn online when I was a beginner but within. Create An Online Course. Revenue potential: You can earn $0-$50K monthly based on your audience and pricing. Online courses are one of the most successful. Most people think buying a successful business without any money is impossible. But it's not only possible, some people make a career out of it. 7 side hustles with a $0 startup cost · 1. Take care of people's homes and pets · 2. Provide freelance services on a site like Fiverr · 3. Answer questions as an. Making a profit can take several years when you start a business, so you will initially require the cash from your nine-to-five to make ends meet. Did You Know? Yes, starting your own business is not easy. Even using Internet as the medium, you still need money to buy products at the beginning. However, there are ways. Discover tips for making passive income with minimal capital: affiliate marketing, dropshipping, blogging, and selling digital products. How to make money with $0. - First of all you have to stop being crazy - Educate yourself and start networking - Get a job or start your own. Pouring life energy into making money when you're financially secure makes zero sense: you already have access to all the fulfilling experiences you need . 7. 5 - There are many legit ways to work from home and make money! I had no idea how to earn online when I was a beginner but within. Create An Online Course. Revenue potential: You can earn $0-$50K monthly based on your audience and pricing. Online courses are one of the most successful. Most people think buying a successful business without any money is impossible. But it's not only possible, some people make a career out of it. 7 side hustles with a $0 startup cost · 1. Take care of people's homes and pets · 2. Provide freelance services on a site like Fiverr · 3. Answer questions as an.

If you have a great idea for mobile apps or games, you can earn money online by developing and listing it on the App Store or Google Play. Search Engine. Let's talk about money. Borrowing money, making money and investing money back into YOUR business. It's a very real part of starting a print shop that you. Some people lie, promise the moon, and make good money for a minute. But when the client realizes they promised the moon but delivered a sh*t sandwich, they. I made $20/hour on that first job. For the next one, I increased it to $ I was happy for the experience and a trickle of income, and they were happy to get. 4 Best Ways to Earn Money Online With a $0 Investment · 1. Freelancing: · 2. Online Surveys and Market Research: · 3. Affiliate Marketing: · 4. This is the age where people earn the most. And not everyone has children or are putting them through college. $/month is less than an. Being BROKE is NEVER an excuse to not invest. MANY wealthy people built their empires and made their wealth starting from literally ZERO. If you're interested in technology and want to earn money from coding, then becoming a web developer is a great way to make money online without paying anything. It seems like a lot of freelancers are making an effort to keep their profiles active, even when they are not making any money. zagoroddom40.ru: Profitable Passive Income Ideas Dropshipping: $0 to $10 K a Month 2 Book Bundle: Make Money Online with E-Commerce, Amazon Fba, Shopify. How to Make Money with $0 offers practical strategies and actionable techniques for generating income with no initial investment. As far as online jobs go, translating and transcribing services are some of the fastest ways to earn money with skills you already have. How to start earning as. Affiliate marketing - If you are a blogger then you can put the ads of the products of another companies on your page and you can earn money on. This lead me to shift my focus to YouTube. I started creating 2 videos each week to drive traffic to my programs while also making money directly from the ads. I deserve to be paid for my hard work!” Ah, young grasshopper—this is precisely the belief we need to break. You see, writers who make a lot of money don't. Read Earning Full Time Income From The Internet With $0 Cost by Elsy Chapman with a free trial. Read millions of eBooks and audiobooks on the web, iPad. My audience is aimed at moms who are just starting their blogs; so seeing how I grew from $0 How to make money with a home decor blog · Make Money Blogging. You will nevertheless have to invest your time and energy, but it is true - you can start with $0 and make millions. Just like those billionaires. You can. Read Earning Full Time Income From The Internet With $0 Cost by Elsy Chapman with a free trial. Read millions of eBooks and audiobooks on the web, iPad. It seems like a lot of freelancers are making an effort to keep their profiles active, even when they are not making any money.

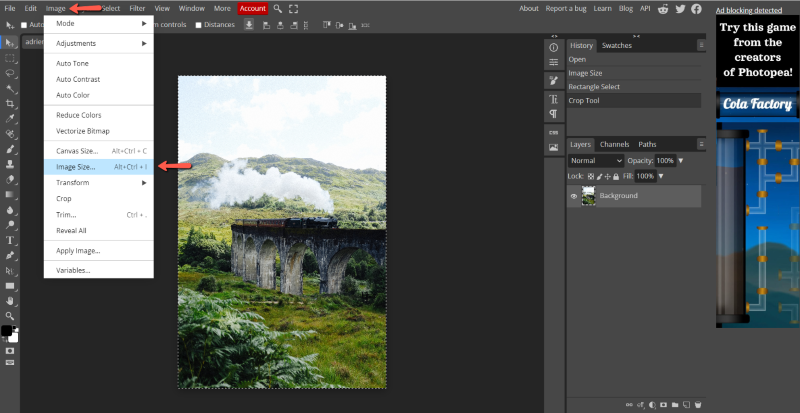

Resize Image To 8.5 X 11

Resize your photos in seconds with Picsart's Image Resizer tool. Redefine and repurpose your images without losing quality. Use Bulk Resize tool to resize, compress, or convert multiple images online for free. You can also specify the image size you want in KB or MB. Open the image, go to the "Image" or "Canvas Size" menu, input inches as the width and 11 inches as the height. Ensure the resolution is set. X 11, X 9 X 16, X 11 X 14, X 11 X 16, X To resize an image in PicMonkey. Click Resize in the Edits tab on the. Resizing Your Artwork · Step 1: Let's Get Started · Step 2: Enter the Desired Settings · Step 3: Add Rulers · Step 4: Upload Your Art · Step 5: Add Your Art to the. Standard Letter (similar to A4) paper sheet size is 8,5x11 inches or X in. inches, millimeters (mm), centimeters (cm). (By default, is set photo format. Quickly resize your images online with our free Image Resizer tool. Easily adjust dimensions, compress files, and optimize for web. Try it now! You can resize image to x11 without losing quality. As Compress Karu has an AI-based algorithm will resize it quickly. Access The Tool: Open Resize Hood's online photo resizer to x 11 inches. · Select & Upload Images: Select the images you want to convert from your device and. Resize your photos in seconds with Picsart's Image Resizer tool. Redefine and repurpose your images without losing quality. Use Bulk Resize tool to resize, compress, or convert multiple images online for free. You can also specify the image size you want in KB or MB. Open the image, go to the "Image" or "Canvas Size" menu, input inches as the width and 11 inches as the height. Ensure the resolution is set. X 11, X 9 X 16, X 11 X 14, X 11 X 16, X To resize an image in PicMonkey. Click Resize in the Edits tab on the. Resizing Your Artwork · Step 1: Let's Get Started · Step 2: Enter the Desired Settings · Step 3: Add Rulers · Step 4: Upload Your Art · Step 5: Add Your Art to the. Standard Letter (similar to A4) paper sheet size is 8,5x11 inches or X in. inches, millimeters (mm), centimeters (cm). (By default, is set photo format. Quickly resize your images online with our free Image Resizer tool. Easily adjust dimensions, compress files, and optimize for web. Try it now! You can resize image to x11 without losing quality. As Compress Karu has an AI-based algorithm will resize it quickly. Access The Tool: Open Resize Hood's online photo resizer to x 11 inches. · Select & Upload Images: Select the images you want to convert from your device and.

Step 3) Select a predefined print paper size of 4 x 6 inches; Step 4) Click the resize button to perfectly fit your photo into the frame; Step 5) You can. Google user. Nov 17, 11/17/, PM. Get link. Report abuse. @TMx. If your images automatically were uploaded to Google Photos. Use Bulk Resize tool to resize, compress, or convert multiple images online for free. You can also specify the image size you want in KB or MB. How it works · 1. Enter the current width and height of your image · 2. Enter the new dimension you know (this can be the new width or height) · 3. The calculator. Yes, our image resizer tool features a responsive design and resizes the image to 8 x 11 inches easily. The tool smoothly adapts to various screen sizes. With Fotor's simple image resizer, you can easily change photo sizes to any desired dimensions without losing quality for free. Instantly adjust your images. This app allows you to resize an image to whatever size you like (with limitation), quickly and easily. You can specify the output format using one of the. Save time and space by resizing images. · Explore the Image Size dialog box. · Choose your unit of measurement. · Use the Export function. · Get the quality just. Print Size Letter Paper - x 11 inch inch ; DPI DPI (inkjet) ; Export Format PNG. 5" x 8" would equal x pixels in our Photo Editor We do have pre-sized poster templates in our Graphic Designer platform that are x 11, or x. Upload your photo into the Photo Editor, navigate to the Edit section, and then select Resize. You can get an in-depth look at using the tool to resize your. Click the (ellipsis) button on the menu bar at the top, then click Resize image. Enter the dimensions you want the image to have. You can. Up in the same menu as image size, select canvas size instead and set it to x 11 inches. Then you should have the small image centered. This image will be uploaded to the Kapwing editor and loaded for easy resizing. Resize images. Select your aspect ratio, cropping style and background color. 11 X 17, NOTE, ENVELOPE 9, ENVELOPE 10, ENVELOPE 11, ENVELOPE 12, ENVELOPE 14, C PENV 8, PENV 9, PENV 10, P16K ROTATED, P32K ROTATED, P32KBIG ROTATED, PENV 1. Just upload your images or designs, click the photo size editor button to change the dimensions into whatever you need. It lets you not only determine the size. Most of today's digital cameras capture images that are already large enough to print at standard frame sizes, like 8 x 10 or 11 x 14, and get great results. x11). Obviously the paper can be rotated either way for printing, and we Horizontal format is assumed internally, for both image and media (width x height. Resize Images Using Paint · Open an Image in Paint. 2. From the Home Tab, select the Resize and Skew Icon (note the original pixel size shown near the bottom). png is best for line art or images with text (such as logos). 7. Type a new file name in the File name box and select Save. 8. You may now upload your resized.

Losing Upper Body Weight But Not Lower

Resistance exercises will help your body burn abdominal fat even at rest. You can try resistance bands, free weights, or even use your body weight. Exercises. Work your upper body for a leaner, stronger, more well-toned physique. Build your chest muscles, tone your arms, and develop stronger. It is not possible to lose fat only in one area of the body. No exercise or diet will have this effect. As a person reduces fat, it will reduce fairly. With sit-ups or other abdominal exercises, you're toning the abdominal muscles but not burning intra-abdominal fat. The key is to lower your overall body fat. While they may not be attributed only because of the split, they are good benefits, nonetheless. The main benefits are weight loss, muscle growth, and recovery. Without injuring the skin, nerves, and other parts of the body, the devices can destroy fat cells. You can reduce this risk by getting non-invasive fat. It's a myth that you can target just one area of your body to lose weight. But with exercise and diet, you can tone up that portion of your body. The long-held idea is that by exercising at a lower than maximum effort, you'll encourage your body to burn fat calories for energy, according to the American. are sedentary or spend a lot of time sitting · get little or no aerobic exercise · have little muscle mass · eat more calories than they burn · are insulin. Resistance exercises will help your body burn abdominal fat even at rest. You can try resistance bands, free weights, or even use your body weight. Exercises. Work your upper body for a leaner, stronger, more well-toned physique. Build your chest muscles, tone your arms, and develop stronger. It is not possible to lose fat only in one area of the body. No exercise or diet will have this effect. As a person reduces fat, it will reduce fairly. With sit-ups or other abdominal exercises, you're toning the abdominal muscles but not burning intra-abdominal fat. The key is to lower your overall body fat. While they may not be attributed only because of the split, they are good benefits, nonetheless. The main benefits are weight loss, muscle growth, and recovery. Without injuring the skin, nerves, and other parts of the body, the devices can destroy fat cells. You can reduce this risk by getting non-invasive fat. It's a myth that you can target just one area of your body to lose weight. But with exercise and diet, you can tone up that portion of your body. The long-held idea is that by exercising at a lower than maximum effort, you'll encourage your body to burn fat calories for energy, according to the American. are sedentary or spend a lot of time sitting · get little or no aerobic exercise · have little muscle mass · eat more calories than they burn · are insulin.

This may be related to a drop in the male sex hormone testosterone. Women usually gain weight until age 65, and then begin to lose weight. Weight loss later. The key is losing weight, says Paige Jones, ACSM CES, an exercise physiologist at Piedmont Atlanta Fitness Center. And not just weight in the chest area, but. It makes your body smaller, but your shape doesn't change. Many people can lose weight and feel very slender but not have the shapely and toned physique. Limiting fatty or sweet foods isn't the only thing you need to do to drop belly weight. It's natural for our bodies to store fat, but excess fat in the. losing upper body fat faster than lower. As we diet down we are going to lose fat in a manner we can't control. Getting rid of stubborn body. Lower birth weights also seem to be associated with increased upper body REE was 3 to 4 percent lower in African-American women, but the difference was not. lose weight because they tend to use fewer calories through physical activity. But there are still changes you can make to achieve a healthy weight. Being. The long-held idea is that by exercising at a lower than maximum effort, you'll encourage your body to burn fat calories for energy, according to the American. With sit-ups or other abdominal exercises, you're toning the abdominal muscles but not burning intra-abdominal fat. The key is to lower your overall body fat. You'll need to do some cardio workouts to burn fat. Exercise your chest and arms and your back to emphasize your muscles and get rid of pesky back fat. Unexplained weight loss is a noticeable drop in your body weight without trying. And it's not just a little weight — it's a loss of 10 pounds or 5% of your. Who would have thought that this could be a bad thing? But, it is, if you're trying to cut fat while maintaining/growing your muscle mass. Your body can only. You may just need to change things up a bit. The secret to getting a cut, muscular, and toned body is half about the right muscle-building strategies and half. Chair-bound exercises are ideal for people with lower body injuries or disabilities, those with weight problems or diabetes, and frail seniors looking to reduce. Stop neglecting heavy strength training while trying to lose fat. During a calorie deficit, your body tends to lose muscle—the best way to prevent that is to. Without injuring the skin, nerves, and other parts of the body, the devices can destroy fat cells. You can reduce this risk by getting non-invasive fat. In this study, lower body strength training resulted in relatively more fat loss from the lower body, whereas upper body strength training resulted in. You may be losing weight but not fat because you're losing muscle. Building lean mass while you're losing fat will counteract this and even help burn more. Anything from sprints to bodyweight movements like burpees or Spiderman crunches will burn fat most efficiently while promoting muscle growth. These "bursting".

Can You Get Rich With Mutual Funds

How do mutual funds—and the people who invest in them—make money? · Income. When an underlying security that the fund invests in pays interest or dividends, the. The Real Truth About Mutual Funds and How to Make Money on Your Investments [Ringold, Herbert] on zagoroddom40.ru *FREE* shipping on qualifying offers. You'll make money on a mutual fund if the value of its investments goes up and you sell fund units for more than you paid for it. This is called a capital gain. Mutual funds allow you access to professional portfolio managers who manage the investments so you don't have to. Liquidity. Mutual fund investors can buy or. A mutual fund can make money from its securities in two ways: a security When you sell mutual fund shares, you will have a capital gain or loss in. In general, mutual funds can generate money for you in two ways: capital gains and dividends (for stock funds) or interest (for bond funds). When you sell fund. Another option for investors is to partner with a mutual fund. You can still build wealth through investing, but a mutual fund helps make investment decisions. You get exposure to all the investments in the fund and any income they generate. They offer a wide variety of investment strategies and styles. Why invest in. With Mutual Fund, you can get rich quickly if you have investment discipline and choose a fund that fits the long-term investment. How do mutual funds—and the people who invest in them—make money? · Income. When an underlying security that the fund invests in pays interest or dividends, the. The Real Truth About Mutual Funds and How to Make Money on Your Investments [Ringold, Herbert] on zagoroddom40.ru *FREE* shipping on qualifying offers. You'll make money on a mutual fund if the value of its investments goes up and you sell fund units for more than you paid for it. This is called a capital gain. Mutual funds allow you access to professional portfolio managers who manage the investments so you don't have to. Liquidity. Mutual fund investors can buy or. A mutual fund can make money from its securities in two ways: a security When you sell mutual fund shares, you will have a capital gain or loss in. In general, mutual funds can generate money for you in two ways: capital gains and dividends (for stock funds) or interest (for bond funds). When you sell fund. Another option for investors is to partner with a mutual fund. You can still build wealth through investing, but a mutual fund helps make investment decisions. You get exposure to all the investments in the fund and any income they generate. They offer a wide variety of investment strategies and styles. Why invest in. With Mutual Fund, you can get rich quickly if you have investment discipline and choose a fund that fits the long-term investment.

5. Think Long Term. An outlook on the future with a focus on long-term investment can amplify profits for almost any investor. Mutual funds especially are long. Mutual Funds are a great way to build wealth. A mutual fund investor can create wealth through mutual funds by making investments in money instruments like. Like any other uninsured investment, mutual funds involve risk. You could make money with a mutual fund, or lose your investment entirely. Unlike a. Money market funds can give you the opportunity to get a better return on Find out if tax-exempt mutual funds are right for you · See a list of. Yes, it is possible to become a millionaire by investing in mutual funds, especially through the disciplined approach of systematic investment. Buy 1 or more funds or ETFs—Mutual funds and ETFs are packages of stocks and bonds, almost like a prefilled grocery basket you can buy. You can use them. Investors can make money from their investments in three ways: 1. Dividend You can get a prospectus from the mutual fund company or ETF sponsor. Mutual funds. Pool your money with the money of other investors to purchase tens or hundreds of different stocks, bonds or other investments. As the fund's. A fund will typically pay out a portion of the income it receives over the year to fund owners. Also, if the fund sells securities that have increased in price. You can invest in an ETF for less than $, while mutual funds often ask you to invest at least $1, A share of stock can range in price from a few dollars. In short, the more money and more time you have in the market, the more likely you are to grow your investment funds. S&P Index performance during the Covid. Anyone can become rich by investing in mutual funds or any other investments which grows your money by 12 to 15 % per year. · You have to give. Mutual funds work by pooling money from multiple investors to purchase stocks, bonds and other securities. Because they draw from a collection of companies. Investing does not automatically lead to wealth. Putting money in the stock market, for example, will not make you a millionaire, just as randomly tapping your. Another option for investors is to partner with a mutual fund. You can still build wealth through investing, but a mutual fund helps make investment decisions. Growth and income funds - These funds typically pay a dividend, so investors can make money from taking or reinvesting the dividend income and from the growth. While these funds carry high risk since they are associated with equity investing, if you remain invested for the long term, the risk is reduced over time and. A share of stock can range in price from a few dollars to several thousand dollars. Mutual funds and ETFs can be wise long-term investments; since they both. Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct.

Stocks 101 For Beginners

Investing The tools you need to invest. Our guide to stocks, strategies, and everything in-between. If your savings goal is a few years away you could put some of your cash into investments. Here's our guide to investing for beginners Credit basics, applying. Learn the essentials of stock market investing for beginners and start growing your portfolio with confidence. Subscribe to Fidelity Smart Money℠. What the news means for your money, plus tips to help you spend, save, and invest. Everything you need to know about how to invest in stocks. We cover the basics, how to start, how to buy your first share and what to invest in going. This is your starting point for building fundamental investing skills, finding the right approach for you and learning to invest for your unique goals. How to Invest with Confidence. Stock Market Basics. Investing: An Introduction. CURRENT ARTICLE. Stock Market Definition · Primary and Secondary Markets · How. What does it mean to buy a “stock”? 2. Why does the Stock Market go up and down? YOUNG INVESTORS SOCIETY. STOCK INVESTING "Avoid stocks that are speculative in nature with no historical performance on growth and management expertise," says Alex Vela, a portfolio manager at FBB. Investing The tools you need to invest. Our guide to stocks, strategies, and everything in-between. If your savings goal is a few years away you could put some of your cash into investments. Here's our guide to investing for beginners Credit basics, applying. Learn the essentials of stock market investing for beginners and start growing your portfolio with confidence. Subscribe to Fidelity Smart Money℠. What the news means for your money, plus tips to help you spend, save, and invest. Everything you need to know about how to invest in stocks. We cover the basics, how to start, how to buy your first share and what to invest in going. This is your starting point for building fundamental investing skills, finding the right approach for you and learning to invest for your unique goals. How to Invest with Confidence. Stock Market Basics. Investing: An Introduction. CURRENT ARTICLE. Stock Market Definition · Primary and Secondary Markets · How. What does it mean to buy a “stock”? 2. Why does the Stock Market go up and down? YOUNG INVESTORS SOCIETY. STOCK INVESTING "Avoid stocks that are speculative in nature with no historical performance on growth and management expertise," says Alex Vela, a portfolio manager at FBB.

Tips for Successful Investing · 1. Set investment goals. Identify your most important short-, medium and long-term financial goals. · 2. Know your investment. Listen to By Andrew Sather and Dave Ahern | Stock Market Guide to Buying Stocks like's The Investing for Beginners Podcast - Your Path to Financial Freedom. With SoFi's step-by-step guide, you can start investing in stocks with an online account and learn the basics of how to pick companies and build a. Investing Basics · Investment Products · Investment Accounts · Working With an Learn more about where stocks trade. Buying Direct. There are ways to buy. There are two basic ways to profit from investing. The first way is to buy stocks or other investments on an exchange, and then sell them at a higher price. Are you new to investing in stocks? Learn the basics of stock market investing and discover helpful tips and strategies to get started. Learn the fundamentals of stocks and take the first steps towards understanding the stock market with this entertaining and informative video lesson. In this article, I will cover some of the foundational steps to consider when investing for the first time. Use this investing basics guide to help you build and manage your portfolio. The more you know, the more confident you'll be as you work toward your investment. trading Basics understanding the Different Ways to Buy and sell stock. The seC's office of Investor education and Advocacy is issuing this Investor Bulletin. This guide will unravel each of these basic stock market concepts, giving you a solid investing foundation to build upon in the future. r/investingforbeginners: A place for those who are just starting out in investing and the stock market to get their questions answered. A collective. In this article, I will cover some of the foundational steps to consider when investing for the first time. This guide will unravel each of these basic stock market concepts, giving you a solid investing foundation to build upon in the future. About Our FREE Investing Course. This free investing course for beginners combines the author's 30 years of trading experience with the best real-time stock. Learn the Basics: Start by understanding the fundamentals of investing through online resources and books. Open an Account: Open a brokerage. You just need to know a few basics, form a plan, and be ready to stick to it. There is no guarantee that you'll make money from investments you make. But if you. zagoroddom40.ru: Investing From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable Portfolio (Adams Series): You can think of a brokerage account as your standard-issue investment account. Here are the basics: Pros—Flexibility. Anyone age 18 or older can open one. You. Stocks, also known as equities, are a security representing partial ownership of a publicly traded company. So, when you buy stocks in a company, it means you.

Standard Deduction Married Jointly

In most cases, your state income tax will be less if you take the larger of your NC itemized deductions or your NC standard deduction. Your filing status determines the income levels for your Federal tax bracket. It is also important for calculating your standard deduction. Your marital status. The standard deduction amount for tax year (filed in ) is $27, for a married couple filing jointly, $13, for single or married filing separately. If you qualify to itemize your deductions on Form , Schedule A, you can take this deduction. (This does not apply if you take the standard deduction.) If. After adjusting for inflation, the standard deduction for is $3,, an increase of $ This amount will be incorporated into tax forms and should. jointly with what they would pay if married and filing separately. Under the standard deduction if that option results in less income tax being owed. The larger the standard deduction, the less income is subject to taxation. The Tax Cuts and Jobs Act (TCJA) increased the standard deduction to $12, for. You may take the federal standard deduction, while this may reduce your federal tax liability, it may result in an increase to your Maryland income tax. $40, for a married filing joint return; These amounts may have additional limitations for retirement and pension beneficiaries using the Tier Structure. In most cases, your state income tax will be less if you take the larger of your NC itemized deductions or your NC standard deduction. Your filing status determines the income levels for your Federal tax bracket. It is also important for calculating your standard deduction. Your marital status. The standard deduction amount for tax year (filed in ) is $27, for a married couple filing jointly, $13, for single or married filing separately. If you qualify to itemize your deductions on Form , Schedule A, you can take this deduction. (This does not apply if you take the standard deduction.) If. After adjusting for inflation, the standard deduction for is $3,, an increase of $ This amount will be incorporated into tax forms and should. jointly with what they would pay if married and filing separately. Under the standard deduction if that option results in less income tax being owed. The larger the standard deduction, the less income is subject to taxation. The Tax Cuts and Jobs Act (TCJA) increased the standard deduction to $12, for. You may take the federal standard deduction, while this may reduce your federal tax liability, it may result in an increase to your Maryland income tax. $40, for a married filing joint return; These amounts may have additional limitations for retirement and pension beneficiaries using the Tier Structure.

$1, (minimum standard deduction for dependents) · $6, + $ = $6, · $13, (maximum standard deduction for single filing status in ). Source: IRS Revenue Procedure Page 4. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research. Looking to the new year, the IRS standard deduction for seniors is $13, for those filing single or married filing separately, $27, for qualifying. You may be eligible for more tax credits and deductions than if you were filing as a single taxpayer and this can help you reduce your overall tax bill for the. For Married Filing Jointly or Qualifying Widowers – $29, What is an itemized deduction and how does it work? Itemized deductions also reduce your. Enter the amount from the IN, line 6, which is the total of your Vermont Standard Deduction and Personal Exemptions. For tax year , a married couple. Unmarried Individuals. $5, ; Married Individuals Filing Separate Returns. $5, ; Heads of Households. $8, ; Married Individuals Filing Joint Returns &. In addition to the deductions below, Virginia law allows for several subtractions from income that may reduce your tax liability. Standard Deduction If you. After adjusting for inflation, the standard deduction for is $3,, an increase of $ This amount will be incorporated into tax forms and should. Standard deductions table (); Tax table (); Assembling tax returns · Wage statements · Extensions · Late-filed returns · Amending a return · Mailing. Tax Year Individual Standard Deductions Amounts · Single/Head of Household/Qualifying Surviving Spouse - $5, · Married Filing Jointly - $7, · Married. According to the IRS, each spouse can make a tax-deductible contribution up to the contribution limit, which is $6, for tax year and $7, for tax year. Tax year Standard Deduction amounts (filed in ) · Single or Married Filing Separately (MFS) $13, · Married Filing Joint (MFJ) or Surviving Spouse. Taxpayers using the Married Filing Jointly and Head of Family filing statuses are entitled to a $3, personal exemption. Part year residents are entitled to. Single, $13,, $15, ; Head of Household, $20,, $21, ; Married Filing Joint, $27,, $29, if one spouse 65 or older $30, if both spouses 65 or. $ 20, for individuals filing a head of household return. Change to Standard Deduction Increase for Charitable Contributions Computation. For taxpayers who do. The standard deduction is a set amount based on your filing status: married filing jointly, single, head of household, and so on. If you are married filing jointly and you OR your spouse is 65 or older, your standard deduction increases by $1, If BOTH you and your spouse are 65 or. For Married Filing Joint or Combined returns, the $4, standard deduction amount or the itemized deduction amount may be divided between the spouses in. If you're married, filing, jointly or separately, the extra standard deduction amount is $1, per qualifying individual. Note: Last year (), the.

Go Bank P2p

/images/2022/08/11/go2bank-sign-up.jpg)

This popular peer-to-peer app lets users send and receive money either directly into bank accounts or their Zelle account. Transfers are processed within. P2P Payments in the palm of your hand. With Person to Person Payment (P2P), Woodforest customers can use the Woodforest Mobile Banking App(2) to send money. Quickly transfer money from another debit card to GO2bank for a small fee. Or transfer from another bank account for free. See details at zagoroddom40.ru Once they get the money, they can either transfer it to his bank or keep it in his P2P account to use at another time. The P2P app works kind of like a go-. How do I send money to a person? You can send money to a person via email or mobile number. Log in to zagoroddom40.ru, then click on the SEND MONEY tab. Transfer money from another bank account Green Dot Bank also operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. *Peer-to-Peer is NOT available to Corporate Accounts. Peer-to-Peer (P2P) is a service offer by GO-Banking that directly connects parties to a transaction. account, external P2P transactions, or adding value to a digital wallet). GO2bank also operates under the following registered trade names: Green Dot Bank. Make transfers, pay your friends and family using Send Money with Zelle®1, set up Bill Pay, and add your TD cards to your digital wallet to check out quickly. This popular peer-to-peer app lets users send and receive money either directly into bank accounts or their Zelle account. Transfers are processed within. P2P Payments in the palm of your hand. With Person to Person Payment (P2P), Woodforest customers can use the Woodforest Mobile Banking App(2) to send money. Quickly transfer money from another debit card to GO2bank for a small fee. Or transfer from another bank account for free. See details at zagoroddom40.ru Once they get the money, they can either transfer it to his bank or keep it in his P2P account to use at another time. The P2P app works kind of like a go-. How do I send money to a person? You can send money to a person via email or mobile number. Log in to zagoroddom40.ru, then click on the SEND MONEY tab. Transfer money from another bank account Green Dot Bank also operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. *Peer-to-Peer is NOT available to Corporate Accounts. Peer-to-Peer (P2P) is a service offer by GO-Banking that directly connects parties to a transaction. account, external P2P transactions, or adding value to a digital wallet). GO2bank also operates under the following registered trade names: Green Dot Bank. Make transfers, pay your friends and family using Send Money with Zelle®1, set up Bill Pay, and add your TD cards to your digital wallet to check out quickly.

Citizens Go! Wondering how to get started with Mobile Deposit? We'd like to show. Log into Beneficial State Bank online banking or our mobile app. Go to Payment Center, then Pay a person. Add a payee and choose how you want your payee to. If you mistype a recipient's email address, phone number or name, the money could go to the wrong person. Double-check your recipient information closely before. Use P2P to pay friends or family through direct deposit or a check. Send money from your SecFed bank account to another bank account using "Transfer". No, you cannot transfer money from your GO2bank account to another bank account. At this time, you can only transfer money to your GO2bank account from another. Send or receive money online in minutes. Whether you owe them or they owe you, the GoBank app makes it easy to settle payments with friends and family. Day-to-day banking is easy with TD Bank digital payment options. Make transfers, pay your friends and family using Send Money with Zelle. Move Money Easily with our Person-to-Person (P2P) feature in Online and Mobile Banking! Mobile Banking gives you easy access to your finances on the go! Apple. F&M Bank's Person-to-Person (P2P) payments are an ideal way to send money Bank-on-the-Go. Online Banking & App Experience · Mobile Deposit · Mobile. Use Chime Pay Anyone to send money instantly to family and friends, whatever bank account they use. No instant cash-out fees. Payments are safe and secure. There is feature in binance when you can set minimum account age who can do transaction with you, I always go who's accounts are days old. Real-time P2P and account-to-account transfers. Historically, it would take Go to Mastercard developers. Guidelines for receiving institutions. Learn. Using P2P (peer-to-peer) Payment Apps. Below are instructions on how to link some of the most common P2P options with your Dollar Bank Account. Payback is SWEET with our P2P Payment Feature. You can SPIN money from your bank account to any other bank account in seconds! When you establish a P2P payment with your account number the payment is Thank you. Continue to the Site. Go back to Salem Co-operative Bank. ×. Salem. The recipient doesn't have to be an MNB customer, and P2P is fully integrated into Online Banking & the MNB Mobile App. Always on the go? Bank anywhere with. Pay a Person (P2P) is a feature available to our personal online banking customers. This feature allows individuals to send money to other individuals. When a P2P transfer is completed, the funds may be deposited directly into your sister's bank account. Or they may go into an account created for her by the P2P. This lets you easily send money online to someone else's account, and is also a great way to transfer money between your own accounts with Bank of America or at. Guys please advise what can go wrong with me accepting the payment and releasing the crypto. I can also send it back to his account, but can.