zagoroddom40.ru

Market

How To File Personal Bankruptcy

Individual Income Tax. Married individuals may file bankruptcy jointly or separately. If only one spouse files bankruptcy, but the tax returns were filed. personal and business debts and property in your case. Generally, there are no minimum financial requirements for a debtor to file a bankruptcy case. Before you consider filing a Chapter 13 here are some things you should know: You must file all required tax returns for tax periods ending within four years of. Chapter 7 works best for those who have credit cards, medical or personal loan debt. Chapter 13 Bankruptcy. Chapter 13 bankruptcy sets up a court-approved. Before you consider filing a Chapter 13 here are some things you should know: You must file all required tax returns for tax periods ending within four years of. With that in mind, you need copies of personal documents including tax forms, pay stubs, proof of income, expenses. They may need more depending on your. People can only file for bankruptcy under Chapter 13 if they have less than $, in unsecured debt in cases filed between April 1, , and March 31, What Is a Bankruptcy Discharge and How Does It Operate? One of the reasons people file bankruptcy is to get a “discharge. personal injury caused by driving. In every bankruptcy case, each individual is required to prepare and submit to the court detailed forms concerning his or her property, debts, and financial. Individual Income Tax. Married individuals may file bankruptcy jointly or separately. If only one spouse files bankruptcy, but the tax returns were filed. personal and business debts and property in your case. Generally, there are no minimum financial requirements for a debtor to file a bankruptcy case. Before you consider filing a Chapter 13 here are some things you should know: You must file all required tax returns for tax periods ending within four years of. Chapter 7 works best for those who have credit cards, medical or personal loan debt. Chapter 13 Bankruptcy. Chapter 13 bankruptcy sets up a court-approved. Before you consider filing a Chapter 13 here are some things you should know: You must file all required tax returns for tax periods ending within four years of. With that in mind, you need copies of personal documents including tax forms, pay stubs, proof of income, expenses. They may need more depending on your. People can only file for bankruptcy under Chapter 13 if they have less than $, in unsecured debt in cases filed between April 1, , and March 31, What Is a Bankruptcy Discharge and How Does It Operate? One of the reasons people file bankruptcy is to get a “discharge. personal injury caused by driving. In every bankruptcy case, each individual is required to prepare and submit to the court detailed forms concerning his or her property, debts, and financial.

How do I file for bankruptcy? Only a Licensed Insolvency Trustee (LIT) can administer bankruptcies, which are regulated by the “Bankruptcy and Insolvency Act”. To file for bankruptcy you must have debts over $1, that you are unable to repay. Once you file for bankruptcy a Stay of Proceedings automatically comes into. Individuals can file bankruptcy without a lawyer, which is called filing pro se. Learn more. Use the forms that are numbered in the series to file. Individuals can file bankruptcy without an attorney, which is called filing pro se. However, seeking the advice of a qualified attorney is strongly recommended. Before you file, you'll be required to attend a counseling session with a credit counseling organization approved by the U.S. Department of Justice's U.S. Before you file, you'll be required to attend a counseling session with a credit counseling organization approved by the U.S. Department of Justice's U.S. How to File for Chapter 7 Bankruptcy [O'Neill Attorney, Cara, Renauer J.D., Albin] on zagoroddom40.ru *FREE* shipping on qualifying offers. How to File for. Chapter 7 bankruptcy, the type most individuals file, is also referred to as a straight bankruptcy or liquidation. A trustee appointed by the court can sell. How to File · When to File · Where to File · Update Your Information. POPULAR; Get A discharge releases you (the debtor) from personal liability for certain. While navigating the bankruptcy process will differ somewhat depending on which type you file, the initial petition and filing will likely look very similar. Damages for personal injury you caused when driving while intoxicated Deciding to file for bankruptcy is a big decision. It can affect you for a. Most individual debtors file for Chapter 7, which can also be described as “straight” bankruptcy or “liquidation.” Under this plan all non-exempt assets are. They want to know whether they qualify for a Chapter 7 discharge—the court order that wipes out credit card balances, medical bills, personal loans, and more. Bankruptcy is meant for individuals who cannot make progress in paying down their debts. If this describes your situation, declaring bankruptcy can provide you. How to file a debtor's bankruptcy application · 1. Place a deposit with the Official Assignee · 2. Find a licensed insolvency practitioner to consent to be. Many debtors who file for Chapter 7 bankruptcy are pleased to learn that they can keep some of their personal property. If you owe money on a secured debt (for. Our office will also email this information along with the link and directions for how to join the meeting. The individual filing for bankruptcy must attend the. The Bankruptcy Act requires all individual debtors who file bankruptcy on or after October 17, , to undergo credit counseling within six months before. Who qualifies to file bankruptcy? · owe at least $1, in unsecured debt, · are unable to pay your debts as they come due or · you owe more in debts than the. The 10 Steps Involved When You File for Bankruptcy What Happens When Filing for Bankruptcy · Step 1: Find out if you need to declare bankruptcy. · Step 2: File.

Lien Type First Mortgage

This kind of home loan is known as the "first mortgage" or "first deed of trust." A first mortgage has priority over most subsequently-recorded liens and gets. The Consumer Finance Protection Bureau (CFPB) refers to this type of loan as a “junior-lien” because you are using your home as collateral for another mortgage. A first lien loan is a type of legal debt that is secured by collateral, which means if an SME defaults on a loan, the lender can seize the collateral. Designed after popular programs around the world, the All-in-One First Lien HELOC is the nation's first transactional offset type-mortgage program. Get in Touch. What is it? A First Lien HELOC is a type of mortgage loan that is secured against the equity in your home. Generally set to 10 year terms, this loan product. What is it? A First Lien HELOC is a type of mortgage loan that is secured against the equity in your home. Generally set to 10 year terms, this loan product. First, a mortgage IS a lien against your house. It's a first lien. If you get foreclosed on, the first lienholder gets their money first. I. If you miss payments and default, your lender can place a lien on it and possibly foreclose. This could mean you lose your home as your lender takes possession. A First Lien HELOC is a combination of a traditional mortgage and a Home Equity loan in that the loan amount is the full balance that you owe but you have the. This kind of home loan is known as the "first mortgage" or "first deed of trust." A first mortgage has priority over most subsequently-recorded liens and gets. The Consumer Finance Protection Bureau (CFPB) refers to this type of loan as a “junior-lien” because you are using your home as collateral for another mortgage. A first lien loan is a type of legal debt that is secured by collateral, which means if an SME defaults on a loan, the lender can seize the collateral. Designed after popular programs around the world, the All-in-One First Lien HELOC is the nation's first transactional offset type-mortgage program. Get in Touch. What is it? A First Lien HELOC is a type of mortgage loan that is secured against the equity in your home. Generally set to 10 year terms, this loan product. What is it? A First Lien HELOC is a type of mortgage loan that is secured against the equity in your home. Generally set to 10 year terms, this loan product. First, a mortgage IS a lien against your house. It's a first lien. If you get foreclosed on, the first lienholder gets their money first. I. If you miss payments and default, your lender can place a lien on it and possibly foreclose. This could mean you lose your home as your lender takes possession. A First Lien HELOC is a combination of a traditional mortgage and a Home Equity loan in that the loan amount is the full balance that you owe but you have the.

It can be part of the mortgage process when one (a lien) is placed on a property in a secured loan. In the lending process, this legal claim states that when a. This creates a first lien position, or first mortgage, on your home. As a If you have a HELOC or other type of second mortgage on your home, it. “First mortgage loan” means a mortgage loan secured by a lien on real estate which ranks in the Set appropriate terms and conditions by type of real estate. A mortgage lien is the most common type of voluntary real estate lien, also called a deed of trust lien in some states. Anyone who has financed their home with. State Housing Finance Agencies (HFAs) offer first-lien mortgage products (often called first mortgages by. HFAs) to help low- and moderate-income first-time. Define First Lien Mortgage Loans. Mortgage Loans secured by mortgages or First- Lien Mortgage Loans for that property type. AMRESCO Residential. They will file the Deed of Trust for you at the courthouse. They will issue a title policy in your favor guaranteeing a clear first lien title to the property. The most common type of senior lien holder is a first mortgage lender. If you have a first and second mortgage on your property, the first mortgage. Define First Lien Mortgage Loans. Mortgage Loans secured by mortgages or First- Lien Mortgage Loans for that property type. AMRESCO Residential. A second lien is a mortgage that exists behind a first lien mortgage and is typically used to avoid Mortgage Insurance (MI) and/or Jumbo financing. First lien debt refers to a type of secured debt that holds the highest priority in the repayment hierarchy in the event of a borrower default. As stated above. Home lien is a term for a legal claim placed on a home. Lenders place a lien on a property as collateral to secure mortgage loans to homebuyers. The original mortgage is also a type of lien. Specifically, it's the promissory note, also known as the first deed of trust that can be identified as the lien. Mortgages on your home are usually considered individual loans and analyzed in terms of positions. The position — called lien position — of each mortgage is. first lien loans meeting the definition of loans reported in Schedule HC-S Identifies the product type of the mortgage including the interest type. And the best of this debt is called “first-lien” which means that, if the debtor does not make the required payments, the note holder takes back the property. mortgage. Property type prop_type. Property types: 1 is single. 2 is condo/co-op. 3 is units. 4 is other. Mortgage purpose purpose_type. Mortgage purpose: 1. The first lien gets paid first if you default. The second lien gets paid whatever amount is left over. If there are no funds left after paying the first off. First mortgages and property taxes in first lien position get paid back first. · Second mortgages and other junior liens in second position receive repayment. Second mortgages are often recorded next and are usually in the second position. Judgment liens are frequently junior to a first mortgage and possibly a second.

Car Loan Rates With 800 Credit Score

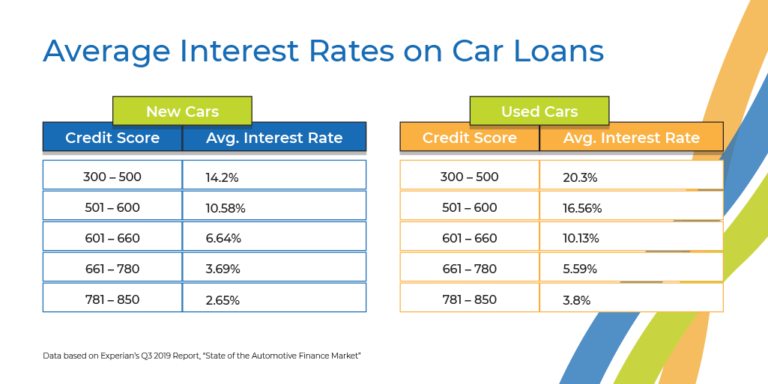

New/Used Auto financing available up to % Loan to Value Representative Example: Financing $25, with no down payment at % for 60 months, payment. With rates starting as low as % APR, we are committed to helping you secure the best interest rate for your auto loan. Is it better to finance a car through. Average Auto Loan Rates by Credit Score ; Deep subprime, , %, % ; Subprime, , %, %. Refinance your auto loan with us and save! Whether you're shopping for a new or used vehicle, or just looking to refinance, Central One makes the process. Average car loan interest rates by credit score ; Nonprime: %. %. ; Subprime: %. %. ; Deep subprime: %. %. New and Used Auto, Auto Lease Buy-outs, and Motorcycle Loans · 4 Year Auto Loans · 5 Year Auto Loans · 6 Year Auto Loans. Borrower Type, FICO Score, Auto Loan Rate (New) ; Super Prime, – , % ; Prime, – , % ; Non-prime, – , % ; Subprime, – APRs range based on factors including transaction type, loan term, payment method, vehicle condition, and credit worthiness/score. ; Routing. Average Interest Rates · – % interest rate (on average) · – % interest rate (on average) · and below: % – % (on average). New/Used Auto financing available up to % Loan to Value Representative Example: Financing $25, with no down payment at % for 60 months, payment. With rates starting as low as % APR, we are committed to helping you secure the best interest rate for your auto loan. Is it better to finance a car through. Average Auto Loan Rates by Credit Score ; Deep subprime, , %, % ; Subprime, , %, %. Refinance your auto loan with us and save! Whether you're shopping for a new or used vehicle, or just looking to refinance, Central One makes the process. Average car loan interest rates by credit score ; Nonprime: %. %. ; Subprime: %. %. ; Deep subprime: %. %. New and Used Auto, Auto Lease Buy-outs, and Motorcycle Loans · 4 Year Auto Loans · 5 Year Auto Loans · 6 Year Auto Loans. Borrower Type, FICO Score, Auto Loan Rate (New) ; Super Prime, – , % ; Prime, – , % ; Non-prime, – , % ; Subprime, – APRs range based on factors including transaction type, loan term, payment method, vehicle condition, and credit worthiness/score. ; Routing. Average Interest Rates · – % interest rate (on average) · – % interest rate (on average) · and below: % – % (on average).

Pay as low as % on your auto loan with 36 monthly payments of $ for each $10, borrowed. New vehicle securing the loan must be current or previous. **% APR is for a 24 - 48 month term, minimum FICO score, includes a % discount for e-signing loan documents and% discount for setting up auto. Auto Loan Rates. As of 08/13/ Term, APR*. 0 - 84 Months, - %. Apply The Purchase, Refinance and Texas Cash Out examples below are based on a. The average auto loan interest rate for new cars in the second quarter of was percent, while used cars had an average rate of percent. You'll typically need an excellent credit score — usually or above — to qualify. Most lenders also evaluate your employment history and debt-to-income. I just purchased a new acadia the best interest rate I could get was my local credit union at % 75 months. Credit Score of +. Actual payment varies based on credit score, loan amount, term, model year, and type of vehicle. U) For the College Auto Loan, borrower must be at least Credit Score Auto Loan Calculator ; , 0%, 3 Years ; , %, 4 Years ; , %, 5 Years. You don't need a specific credit score to buy a car, but higher scores mean lower interest rates. Navy Federal Credit Union explains how to get a lower. Get your new or used car loan from Alliant today! Use our car loan calculator to learn how to get your best rate. Apply online in minutes. How Much Does it Cost? · Alliant's car buying service: % on new cars and % on used (with automatic payments discount). · Standard: % on new and %. Average Auto Loan Rates for Excellent Credit ; Credit Score, New Car Loan, Used Car Loan ; or higher, %, %. New Vehicle ; Primary borrower credit score, +, , , ; Max Term, APR. Minimum credit score of & Loan-to-Value of 90% or less to qualify for advertised APR. Interest rate and APR is determined by credit score and LTV (loan. New and Used Car APR Rates ; Average New Car Loan, Annual Percentage Rate, Average Used Car Loan ; , %, ; , %, ; , You should walk away,with a score of plus you should be able to obtain a loan at 5% APR or less depending on the age of the vehicle and the. Same low rates for both used and new cars as low as % APR! Check the latest savings, certificate (CD), auto loan, and mortgage loan Minimum credit score to qualify for a $10, loan is Minimum credit. RCU offers a variety of vehicle loans with low rates, flexible terms and quick loan decisions — allowing you to enjoy value, convenience and savings! Get on the road with low interest rates ; Model Year, 78 Months, % APR ; Model Year, 84 Months, % APR ; Model Year, 60 Months,

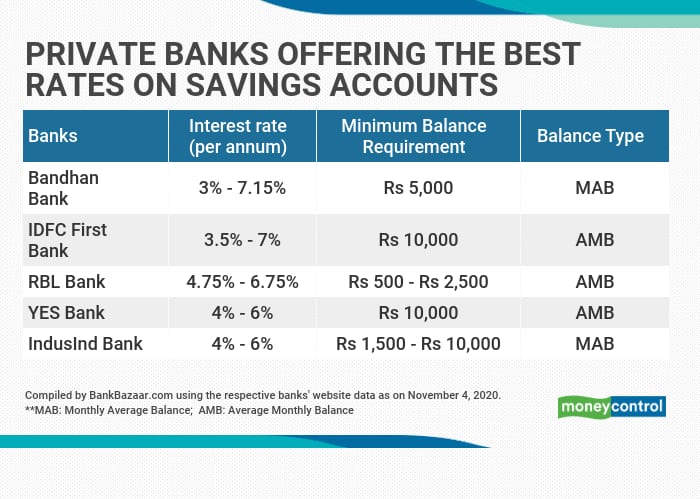

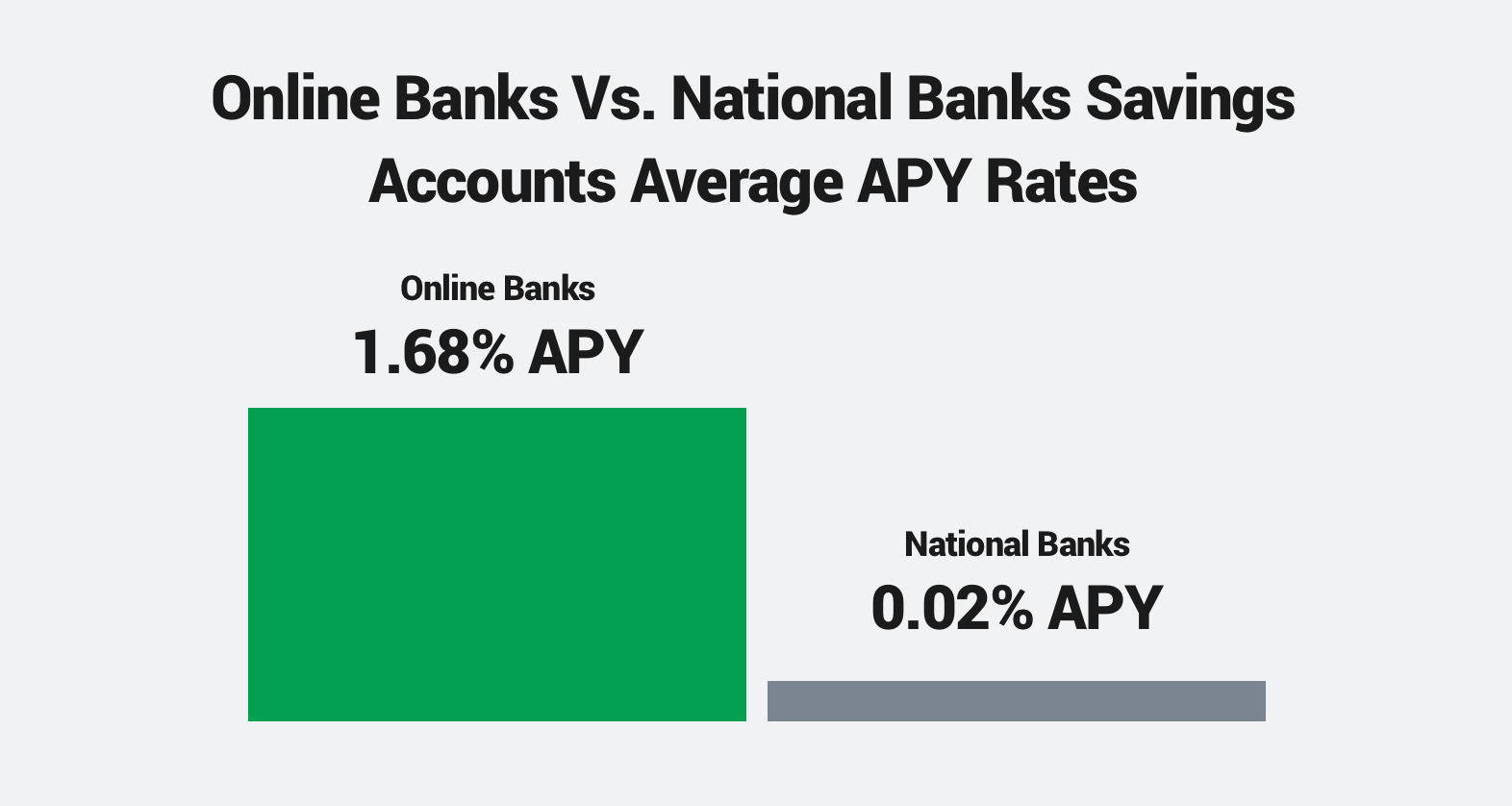

What Bank Gives The Best Interest Rate On Savings Account

Currently, the institution on our best high-yield savings account list with the highest APY is Poppy Bank. Its savings account currently earns a % APY. Bank savings account. Find the best Earn a competitive interest rate, while building your financial commitment and discipline with a savings account. The high-yield savings account from Cloudbank 24/7 offers a market-leading %% APY with no fees and a very low minimum opening deposit of $1. Cloudbank is a. Set aside cash for a big purchase or an emergency fund and earn interest. Find the perfect savings account for your goals. Compare savings accounts. Find the. Our Chase College Checking℠ account has great benefits for students and new Chase checking customers can enjoy this special offer. Refer a Friend. Chase Bank. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep costs down and offer some of. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Currently, the institution on our best high-yield savings account list with the highest APY is Poppy Bank. Its savings account currently earns a % APY. Bank savings account. Find the best Earn a competitive interest rate, while building your financial commitment and discipline with a savings account. The high-yield savings account from Cloudbank 24/7 offers a market-leading %% APY with no fees and a very low minimum opening deposit of $1. Cloudbank is a. Set aside cash for a big purchase or an emergency fund and earn interest. Find the perfect savings account for your goals. Compare savings accounts. Find the. Our Chase College Checking℠ account has great benefits for students and new Chase checking customers can enjoy this special offer. Refer a Friend. Chase Bank. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep costs down and offer some of. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area.

The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. UFB Direct is an online-only bank and a division of the more widely known Axos Bank, headquartered in San Diego. It offers checking, high-yield savings, money. Want a New York bank with some of the best checking and savings rates in town? Check out Apple Bank's rates online and open an account today. 6 The Annual Percentage Yields (APYs) and balances for an HSBC Premier Savings account which are accurate as of 8/26/ are: % APY on balances of $0 -. Best for earning a high APY: Western Alliance Bank High-Yield Savings Account · Best for account features: LendingClub® High-Yield Savings · Best for no minimum. INVESTMENT AND INSURANCE PRODUCTS: NOT INSURED BY THE FDIC • NOT INSURED BY THE FEDERAL GOVERNMENT OR ANY OTHER FEDERAL GOVERNMENT AGENCY, BY THE BANK. Our variable rate is compounded daily to give you the best possible returns. Unlimited Transfers. Access your savings anytime with an unlimited number of. Another traditional bank, CIBC offers up to % APY on your savings, when you meet certain conditions. You'll start off with a lower rate — up to % APY —. Best for earning a high APY: Western Alliance Bank High-Yield Savings Account · Best for account features: LendingClub® High-Yield Savings · Best for no minimum. Bank account interest rates ; Savings Amplifier Account · Savings Amplifier Account · up to $10, · %. $10, and over · % ; Savings Builder Account. Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance Savings · SoFi Checking and Savings. Personal bank accounts and registered products interest rates ; TD Every Day Savings Account · $0 to $ % ; TD High Interest Savings Account · $0 to. Today's banks paying the highest savings account rates are Poppy Bank at % AP, Flagstar Bank at % APY, and Western Alliance Bank at % APY. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. Best everyday rate would be wealthsimple at 4% or motive financial at %. Compare various options of savings bank accounts to find best high interest saving account for you among all savings bank account interest rates. interest rate with our Savings Builder Account Open account. Compare our most popular accounts. table shows benefits and features of available bank accounts. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. Comparison chart ; Hubert Financial · Happy Savings · % ; Laurentian Bank** · High Interest Savings · % ; Manulife Bank · Advantage Account · % ; MAXA. EQ Bank has remained at the top of our list for a while with its 4% rate. The only ones to supplant EQ Bank is none other than EQ Bank. It's simple. You choose.

Which Bank Account Has The Best Interest Rate

UFB Direct: % APY. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep. Hot August Savings Account Rates and Deals · Base rate: % p.a. · The highest maximum rate on our database · % p.a. intro rate applies for 4 months before. Best High-Yield Savings Accounts of August Up to % · SoFi Checking and Savings · CIT Bank Platinum Savings. Compare Savings Accounts up to %. Find the best savings account for you by comparing features such as interest rates, deposit conditions, monthly account. Set up a systematic savings plan—it's the best way to save. Your funds will be automatically deposited into your savings account. Best high-yield savings account rates of August ; Capital One. Performance Savings · % ; American Express National Bank (Member FDIC). High Yield. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. Earn up to % interest per annum, with monthly credit on your savings account. Maximize your savings with IDFC FIRST Bank's competitive interest rates. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. UFB Direct: % APY. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep. Hot August Savings Account Rates and Deals · Base rate: % p.a. · The highest maximum rate on our database · % p.a. intro rate applies for 4 months before. Best High-Yield Savings Accounts of August Up to % · SoFi Checking and Savings · CIT Bank Platinum Savings. Compare Savings Accounts up to %. Find the best savings account for you by comparing features such as interest rates, deposit conditions, monthly account. Set up a systematic savings plan—it's the best way to save. Your funds will be automatically deposited into your savings account. Best high-yield savings account rates of August ; Capital One. Performance Savings · % ; American Express National Bank (Member FDIC). High Yield. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. Earn up to % interest per annum, with monthly credit on your savings account. Maximize your savings with IDFC FIRST Bank's competitive interest rates. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area.

Fee-free online savings with one of the nation's top savings interest rates. Some banks have checking accounts that earn interest—most don't. However. Choose the savings product that is best for you and earn a competitive interest rate to fuel a brighter tomorrow. Learn More. A high interest savings account is generally the lowest-risk investment and most liquid. You will not lose money on a HISA and can transfer into a chequing. Senior Citizen Savings Scheme · Up to ₹1 lakh: % · ₹1 lakh and up to ₹2 lakhs: % · ₹2 lakhs and up to ₹3 lakhs: % · ₹3 lakhs and up to ₹4 lakhs. Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance Savings · SoFi Checking and Savings. Policy interest rate. The Bank carries out monetary policy by influencing short-term interest rates. It does this by adjusting the target for the overnight rate. Canadian High Interest Savings Bank Accounts · Forum · Articles · Profiles · HISA Which banks / credit unions offer the best feature - rate combination? With a high-yield savings account, you can get a solid interest rate and your money grows even faster thanks to compound interest — which lets you earn interest. Personal banking rates. When we say we have your best financial interest in mind, we mean it. Visit here any time to see what you could be earning. Savings. Don't miss out on Gate City Bank's competitive interest rates for checking and savings accounts! Let's keep you (and your dollars) on the up and up. The high-yield savings account from Cloudbank 24/7 offers a market-leading %% APY with no fees and a very low minimum opening deposit of $1. Cloudbank is a. Deposit Interest Rates & APYs. Virginia Consumer & Business Online Rates. Effective: May 18, New Account opening limit is $, in Online Channel. For. Best high-yield savings account rates of August ; Capital One. Performance Savings · % · $0 ; SoFi Bank, N.A.. SoFi Checking and Savings · % · $0. Principality BS offers the top rate overall at 8% fixed for six months on up to £/month. You don't have to pay in every month, though you can't make. I use amex and discover savings. Capitol one is another I used to have. They're all at %. You can find higher if you Google high yield. If you have an individual account I believe you can use it like a checking account. rates, this platform is the best. It is fully FDIC insured. Choose the savings product that is best for you and earn a competitive interest rate to fuel a brighter tomorrow. Learn More. What are regular savings accounts? · Should I get a regular savings account? · Top existing-customer accounts. NewVirgin Money – % fixed; First Direct – 7%. Traditional savings accounts. Standard Savings Account. Best for. First-time So, if you have $1, in your savings account and the interest rate is 2. You'll typically find the lowest interest rates at brick-and-mortar banks. Big banks often offer something close to a % APY on their most basic savings.

Best Cryptocurrency Trading Website

I suggest trying Bitget. Good user experience and great features and most importantly they follow all regulations. eToro - Best overall for crypto trading · Swissquote - Trusted global brand, diverse offering · zagoroddom40.ru - Great selection of crypto CFDs · Interactive Brokers. See our list of cryptocurrency exchanges ✔️ Ranked by volume ✔️ Binance ✔️ Coinbase Pro ✔️ Huobi ✔️ Kraken ✔️ Bithumb ✔️ Bitfinex ✔️ And many more. Binance is the largest cryptocurrency exchange by trading volume, serving M+ users across + countries. With over listed Altcoins. Download CoinSwitch, a crypto app to trade digital currencies like Bitcoin, Ethereum, Tether & other + top cryptocurrencies. CoinSwitch is trusted by 2. Cryptocurrency exchange is a digital platform where users can buy, sell, and trade various cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin. The. Coinbase is a secure online platform for buying, selling, transferring, and storing cryptocurrency Protect your crypto with best in class cold storage. Sign. Currently, the 3 largest cryptocurrency exchanges are Binance, Bybit, and OKX. Total tracked crypto exchange reserves currently stands at. Cryptohopper is the best crypto trading bot currently available, 24/7 trading automatically in the cloud. Easy to use, powerful and extremely safe. I suggest trying Bitget. Good user experience and great features and most importantly they follow all regulations. eToro - Best overall for crypto trading · Swissquote - Trusted global brand, diverse offering · zagoroddom40.ru - Great selection of crypto CFDs · Interactive Brokers. See our list of cryptocurrency exchanges ✔️ Ranked by volume ✔️ Binance ✔️ Coinbase Pro ✔️ Huobi ✔️ Kraken ✔️ Bithumb ✔️ Bitfinex ✔️ And many more. Binance is the largest cryptocurrency exchange by trading volume, serving M+ users across + countries. With over listed Altcoins. Download CoinSwitch, a crypto app to trade digital currencies like Bitcoin, Ethereum, Tether & other + top cryptocurrencies. CoinSwitch is trusted by 2. Cryptocurrency exchange is a digital platform where users can buy, sell, and trade various cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin. The. Coinbase is a secure online platform for buying, selling, transferring, and storing cryptocurrency Protect your crypto with best in class cold storage. Sign. Currently, the 3 largest cryptocurrency exchanges are Binance, Bybit, and OKX. Total tracked crypto exchange reserves currently stands at. Cryptohopper is the best crypto trading bot currently available, 24/7 trading automatically in the cloud. Easy to use, powerful and extremely safe.

1. Binance: Known for its wide range of cryptocurrencies and advanced trading features. · 2. Coinbase: A user-friendly platform suitable for. Kraken Logo Kraken · One of the most trusted cryptocurrency exchanges available in the United States. ; Robinhood Logo Robinhood · Commission-free investing. Download the WazirX Crypto trading app to buy, sell, and hold cryptocurrencies such as Bitcoin, Ethereum, Dogecoin & other + cryptos. CoinCatch stands out as a leading trading platform with its flexible KYC approach. It does not impose VPN restrictions and allows trading. eToro is a renowned global trading platform that has been offering a diverse range of financial investments since and eToro has expanded its services to US. the best trading platform is Trailingcrypto. It ia a unified trading platform which will give you excess to many exchanges like Binance, Bittrex. Pros: Coinbase is one of the most trustworthy and reliable crypto exchange platforms on the web. It allows users to purchase cryptos with fiat currencies, and. Binance is the largest cryptocurrency exchange by trading volume, serving M+ users across + countries. With over listed Altcoins. CoinCatch stands out as a leading trading platform with its flexible KYC approach. It does not impose VPN restrictions and allows trading. Buy, sell, trade and learn about crypto on Kraken — the simple, powerful crypto platform that grows with you. CoinSwitch is one of the best crypto exchanges in India and a popular crypto exchange aggregator platform. It allows users to compare and trade cryptos across. The 10 Best Crypto Trading Bots in (Reviewed) · Coinrule is a great place to start. · Pionex is one of the world's first exchanges with 16 Free built-in. Over million users buy, sell, and trade Bitcoin, Ethereum, NFTs and more on zagoroddom40.ru Join the World's leading crypto trading platform. 7 Best Cryptocurrency Trading Sites For Beginners [Updated ] · Binance · CEX · Coinbase · Bitfinex · Changelly · BitMEX · KuCoin. The cryptoland is. Start trading cryptocurrencies on zagoroddom40.ru's platforms. Take advantage of What's better: CFDs or crypto? Buying cryptos means you're taking. Kraken is a globally operating US-based crypto broker founded in and the world's largest bitcoin exchange in euro volume and liquidity. PrimeXBT is a. Everything is managed within your OANDA app or platform and crypto trading is conducted with Paxos' itBit exchange. risks icon. Understand the risks. We picked SwissQuote as one of the top crypto brokers due to its strong reputation and several key offerings: Strong Regulation and Trust: Swissquote is a Swiss. Cryptocurrency exchanges are platforms for trading cryptocurrency for other assets and traditional currencies. These tools are widely used by individual.

What Fees Will I Pay When Selling My House

Excise tax is the tax you pay to transfer ownership of the home to the buyer. This fee is paid at closing; the total amount is based on the home's sale price. For example, if you have a mortgage and/or Home Equity Line on your home for sale, those will need to be paid with the proceeds of the sale. The mortgage needs. Estimate your home sale profit · Agent Fees: Sellers typically pay % of the home sale price, split between their agent and the buyer's agent. · Closing Costs. Too frequently, sellers are shocked when they discover that they have to pay 6% of the home's property value in commission fees— this usually translates to an. The fee is based on the sales price of the property, and the seller is required to pay the fee at the time of closing. Instead, the resident seller will pay. Most home buyers and sellers should anticipate title fees as a part of closing costs. Estimate the title-related expenses you'll have to pay with our help. How Much Tax Do I Pay When Selling My House? How much tax you pay is any costs related to the sale of your home can be tax deductible. This can. Deed Preparation and Revenue Stamps will not break the bank in most cases, but there are other costs the seller may have to pay. Some of these “incidental”. If your property is part of a homeowners association, then you'll have to pay a prorated portion of your HOA fees. You may also have to pay an HOA transfer fee. Excise tax is the tax you pay to transfer ownership of the home to the buyer. This fee is paid at closing; the total amount is based on the home's sale price. For example, if you have a mortgage and/or Home Equity Line on your home for sale, those will need to be paid with the proceeds of the sale. The mortgage needs. Estimate your home sale profit · Agent Fees: Sellers typically pay % of the home sale price, split between their agent and the buyer's agent. · Closing Costs. Too frequently, sellers are shocked when they discover that they have to pay 6% of the home's property value in commission fees— this usually translates to an. The fee is based on the sales price of the property, and the seller is required to pay the fee at the time of closing. Instead, the resident seller will pay. Most home buyers and sellers should anticipate title fees as a part of closing costs. Estimate the title-related expenses you'll have to pay with our help. How Much Tax Do I Pay When Selling My House? How much tax you pay is any costs related to the sale of your home can be tax deductible. This can. Deed Preparation and Revenue Stamps will not break the bank in most cases, but there are other costs the seller may have to pay. Some of these “incidental”. If your property is part of a homeowners association, then you'll have to pay a prorated portion of your HOA fees. You may also have to pay an HOA transfer fee.

How Much Tax Do I Pay When Selling My House? How much tax you pay is any costs related to the sale of your home can be tax deductible. This can. If you don't have a mortgage, you'll get the entire sale price minus the costs of selling your home. That means you could take home $, if you sell your. The commission fee is typically split between the buyer's and seller's agents and can total between 5% and 6% of the property's selling price. Sellers may also. Real Estate commissions are of course the biggest expense when selling a home. It should be emphasized that commissions are not set in stone and can be. To calculate the proceeds from your home sale, you'll need to subtract the real estate agent fees, your outstanding mortgage balance, closing costs, and any. Both buyers and sellers will have to pay closing costs when the closing documents are signed. These costs can vary, depending on state laws and the property's. Most home buyers and sellers should anticipate title fees as a part of closing costs. Estimate the title-related expenses you'll have to pay with our help. Your listing agent commission usually covers online listing fees, professional photography and videography, advertising on social media and open house expenses. Capital gains tax - paying for your profit When the time comes to sell your property, you will hopefully be selling for a higher price than what was. The main costs you'll pay are estate agency fees, conveyancing fees, paying for an EPC and removal costs. 1. Escrow Fees · 2. Listing Agent Commission · 3. Title Search Fees · 4. Mortgage Balance Payoff · 5. Title Insurance and Fees · 6. County, City or Other "local". The biggest fee you'll have to pay when you sell your home, is the commission fees of the REALTORS ® involved with the sale of the property. Excise tax is the tax you pay to transfer ownership of the home to the buyer. This fee is paid at closing; the total amount is based on the home's sale price. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%. The bulk of the. Example: Phil and Helen, a married couple who who qualify for the $, home sale tax exclusion, sell their home for $, They pay a 6% sales commission. When you add on commissions, taxes, and fees, it can easily cost anywhere from 6% – 8% of the value of a home to sell a house. Despite the creation of Zillow. Results · Real Estate Commission: · Amount Due Lien Holders: · Property Taxes Due: · Other Fees Paid by Seller: · Amount Owed at Closing: · Net Proceeds to Seller. Real estate agent fees or commission; Marketing costs; Conveyancing fees; Capital gains tax (CGT). Let's explore what they are – and how you can prepare for. Your listing agent commission usually covers online listing fees, professional photography and videography, advertising on social media and open house expenses. Capital gains tax - paying for your profit When the time comes to sell your property, you will hopefully be selling for a higher price than what was.

Calculating Mortgage Interest Rate

There are several factors that determine your interest rate, including your loan type, loan amount, down payment amount and credit history. Interest rates are. Refinance savings calculator. Enter your current monthly payment and see how it compares to what you would pay if you refinance at today's rates. Use this. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. For instance, there are a lot of consumers out there today who have amassed a decent amount of revolving debt, so even a very small mortgage rate decrease could. The formula we use in our mortgage calculator is: P = L*(c*(1 + c)^n)/((1 + c)^n - 1), where: P = Monthly mortgage payment; L = Mortgage loan amount; C = Your. Calculate your monthly mortgage payment. Affordability calculator Calculate the price of a home you can afford. Rent or buy calculator Estimate when it makes. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. This calculator is being provided for educational purposes only. The results are estimates that are based on information you provided and may not reflect US. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. There are several factors that determine your interest rate, including your loan type, loan amount, down payment amount and credit history. Interest rates are. Refinance savings calculator. Enter your current monthly payment and see how it compares to what you would pay if you refinance at today's rates. Use this. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. For instance, there are a lot of consumers out there today who have amassed a decent amount of revolving debt, so even a very small mortgage rate decrease could. The formula we use in our mortgage calculator is: P = L*(c*(1 + c)^n)/((1 + c)^n - 1), where: P = Monthly mortgage payment; L = Mortgage loan amount; C = Your. Calculate your monthly mortgage payment. Affordability calculator Calculate the price of a home you can afford. Rent or buy calculator Estimate when it makes. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. This calculator is being provided for educational purposes only. The results are estimates that are based on information you provided and may not reflect US. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization.

Different lenders offer varying interest rates. A lower rate equals a lower monthly mortgage payment. Lengthen the term of your loan. Choose a longer time. The most significant factor affecting your monthly mortgage payment is the interest rate. If you buy a home with a loan for $, at percent your. To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan term. Our calculator limits your interest deduction to the interest payment that would be paid on a $1,, mortgage. Interest rate: Annual interest rate for this. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. The annual cost to borrow money from a lender based on a percentage of the loan amount. Interest rates exclude mortgage "points" and fees charged to get the. Refinance your mortgage: Refinancing your mortgage may help you get a better interest rate and lower your monthly mortgage payments. 4. Switch to an adjustable-. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. This calculator helps you to determine what your adjustable. Use our mortgage calculator to get an idea of your monthly payment by adjusting the interest rate, down payment, home price and more. Use the mortgage calculator to get an estimate of your monthly mortgage payments. Interest Rate. %. Advanced View | Reset. $1, Monthly mortgage payment. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Lenders usually list interest rates as an annual amount. To determine the monthly rate, divide the annual amount by So, if your rate is 6%, the monthly rate. P = the principal amount; i = monthly interest rate. Typically, lenders like to present interest rates on an annual basis, so you'll need to divide the. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Preferred Rewards members may qualify for an origination fee or interest rate reduction based on your eligible tier at the time of application. Depending on. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. A mortgage payment calculator takes into account factors including home price, down payment, loan term and loan interest rate in order to determine how much. Here's how to use the formula: Convert the annual interest rate to a monthly interest rate: Divide the annual interest rate by For example, if your annual. It will quickly estimate the monthly payment based on the home price (less downpayment), the loan term and the interest rate. There are also optional fields.

How To Buy Nio Stock

NIO (NIO) reported Q1 earnings per share (EPS) of -$, missing estimates of -$ by %. In the same quarter last year, NIO's earnings per share . If you want to take a position on NIO shares, you have two options. First, you can buy physical shares in the company through the exchange on which it's listed. Find the stock by using the search function and go to the NIO page. Place an order to buy NIO. Press the 'Buy' button and choose an order type to place your. Find out which Guru investors are buying and selling NIO Inc (NIO) today. Get the latest info and news about NIO stock at zagoroddom40.ru NIO Inc. is a multinational EV manufacturer and one of China's top 6 manufacturers. The company was founded in by Lihong Qin and William Li as NextEV. NIO brand, and family-oriented smart electric vehicles through the ONVO brand. Read More. NYSE; HKEX; SGX. Stock Information. NYSE: NIO. Price. $ Change. +. How to Buy NIO stock: 1. Open A Brokerage Account. To start investing, you will need a brokerage account. There are many brokerage companies on the market. Yes, NIO is available for trading on Robinhood. Robinhood is a popular online trading platform that allows users to invest in stocks, options, and other. You can "buy" NIO shares via derivative trading. Derivatives, such as CFDs, enable you to speculate on positive share price movements without taking ownership. NIO (NIO) reported Q1 earnings per share (EPS) of -$, missing estimates of -$ by %. In the same quarter last year, NIO's earnings per share . If you want to take a position on NIO shares, you have two options. First, you can buy physical shares in the company through the exchange on which it's listed. Find the stock by using the search function and go to the NIO page. Place an order to buy NIO. Press the 'Buy' button and choose an order type to place your. Find out which Guru investors are buying and selling NIO Inc (NIO) today. Get the latest info and news about NIO stock at zagoroddom40.ru NIO Inc. is a multinational EV manufacturer and one of China's top 6 manufacturers. The company was founded in by Lihong Qin and William Li as NextEV. NIO brand, and family-oriented smart electric vehicles through the ONVO brand. Read More. NYSE; HKEX; SGX. Stock Information. NYSE: NIO. Price. $ Change. +. How to Buy NIO stock: 1. Open A Brokerage Account. To start investing, you will need a brokerage account. There are many brokerage companies on the market. Yes, NIO is available for trading on Robinhood. Robinhood is a popular online trading platform that allows users to invest in stocks, options, and other. You can "buy" NIO shares via derivative trading. Derivatives, such as CFDs, enable you to speculate on positive share price movements without taking ownership.

On eToro, you can buy $NIO or other stocks and pay ZERO commission! Follow Nio Inc.-ADR share price and get more information. Terms apply. I'm from the UK and already have NIO shares from NYSE. I'd like to buy more but would prefer the other markets. Is NIO stock a Buy, Sell or Hold? NIO stock has received a consensus rating of buy. The average rating score is and is based on 24 buy ratings, 22 hold. The NIO stock price is USD today. How to buy NIO stock online? You can buy NIO shares by opening an account at a top tier brokerage firm, such as TD. If you want to take a position on NIO shares, you have two options. First, you can buy physical shares in the company through the exchange on which it's listed. Based on 10 Wall Street analysts offering 12 month price targets for Nio in the last 3 months. The average price target is $ with a high forecast of $ Get NIO Inc (NIO:NYSE) real-time stock quotes, news, price and financial information from CNBC. Firstly, they can buy shares in companies on the exchanges where they are listed. For instance, you can buy NIO stock on the NASDAQ exchange, so you own a share. % Past performance is not a guarantee or prediction of future performance. Nio Trading online at zagoroddom40.ru Trade Nio CFDs with live News, Price &. NIO Stock: No Positive Uptrends, But I Still Reiterate A Buy · Oakoff InvestmentsThu, Jul. Comments · See All Analysis». NIO News. NIO attracts a bull. Invest in NIO, NYSE: NIO Stock - View real-time NIO price charts. Online commission-free investing in NIO: buy or sell NIO Stock commission-free with Trading. We explain how to buy Nio Inc Class A ADR stock, compare the best stock trading platforms and use a detailed analysis to learn about (NIO). NIO Stock Performance · Current price: $ · Yesterday's price: $ · Price Change (Last 24 Hours): ↑ (%) · Price Change (Last 14 Days): ↑ ( It currently has a Growth Score of A. Recent price changes and earnings estimate revisions indicate this would not be a good stock for momentum investors with a. NIO isn't a good stock to buy long term. He was so sure that he set I bought some nio stocks at an embarrassingly high price. Lost. Find the latest NIO Inc. (NIO) stock quote, history, news and other (NIO): One of the Best Battery Stocks to Buy According · NIO Inc. (NIO): One. Execute Nio Buy or Sell Advice. The Nio recommendation should be used to complement the buy-or-sell advice compiled from the current analysts' consensus on Nio. NIO real-time stock quote data, in-depth charts, free NIO options chain data, and a fully built financial calendar to help you invest smart. Buy NIO stock at. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. View NIO Inc. Sponsored ADR Class A NIO stock quote prices, financial information, real-time forecasts, and company news from CNN.

Icloud Wallet

Back up your wallet. As an added safeguard, we built an encrypted Google Drive and iCloud feature so you can back up your recovery phrase. We strongly. Apple Wallet & iCloud Account. Got a New phone? What is the Mason Mobile ID Apple & Android Support — For questions about your device software upgrade, Apple. Backing up your wallet to iCloud can be done in a few quick steps. Here's how: Step 1: In the DeFi Wallet's Settings screen, tap Recovery Phrase under the. If you're seeing Pass Disabled when trying to access your Ticketmaster tickets in your Apple Wallet it may be for one of the following reasons. Mobile: iPhone SE, iPhone 6, iPhone 6 Plus or later; iOS 12 or later. Watch: Apple Watch Series 1 or later; Watch OS 5 or later. Apple ID: Signed into iCloud. Tap “Wallet & Apple Pay” and select “Add a credit or debit card”; Enter your In addition, please visit zagoroddom40.ru and follow the. To provide an additional layer of security, the 1inch iOS app offers the ability to backup your wallet to iCloud. This will allow you to gain access to your. Business hours are Monday – Friday am – pm. Where do I go for questions about my Apple ID and/ or iCloud? Can I use Commodore Card in Apple Wallet. Am I able to share my SmarTrip card across multiple iCloud accounts in Apple Wallet? How do I transfer my SmarTrip card from one iPhone to another? (iOS 15). Back up your wallet. As an added safeguard, we built an encrypted Google Drive and iCloud feature so you can back up your recovery phrase. We strongly. Apple Wallet & iCloud Account. Got a New phone? What is the Mason Mobile ID Apple & Android Support — For questions about your device software upgrade, Apple. Backing up your wallet to iCloud can be done in a few quick steps. Here's how: Step 1: In the DeFi Wallet's Settings screen, tap Recovery Phrase under the. If you're seeing Pass Disabled when trying to access your Ticketmaster tickets in your Apple Wallet it may be for one of the following reasons. Mobile: iPhone SE, iPhone 6, iPhone 6 Plus or later; iOS 12 or later. Watch: Apple Watch Series 1 or later; Watch OS 5 or later. Apple ID: Signed into iCloud. Tap “Wallet & Apple Pay” and select “Add a credit or debit card”; Enter your In addition, please visit zagoroddom40.ru and follow the. To provide an additional layer of security, the 1inch iOS app offers the ability to backup your wallet to iCloud. This will allow you to gain access to your. Business hours are Monday – Friday am – pm. Where do I go for questions about my Apple ID and/ or iCloud? Can I use Commodore Card in Apple Wallet. Am I able to share my SmarTrip card across multiple iCloud accounts in Apple Wallet? How do I transfer my SmarTrip card from one iPhone to another? (iOS 15).

Baylor is bringing the exciting experience of adding your Baylor ID Card to Apple Wallet on the iPhone and Apple Watch. With this feature, students, faculty. When you sign out of iCloud all of your cards will be deleted and you will need to set them up again. Sign out of your Coinbase Wallet account and re-import your wallet using your word recovery phrase or Google Drive/iCloud backup. You can do this by opening. Each Ventra Card in Apple Wallet can be moved between devices (iPhone to Apple Watch or from one iPhone to another iPhone) with the same iCloud account up to. With your ID in Wallet, there's no need to reach for your physical ID. Simply add it to the Wallet app and use it to show proof of age or identity. Recently received patent and provided a peek at a likely e-wallet icon for the i-Phone. Currently iTunes Sales $b - plan to launch NFC. If two devices are used, both must be signed into same iCloud account. eAccounts Mobile App, Loaded from Apple App Store by searching Transact eAccounts. Setup. With your ID in Wallet, there's no need to reach for your physical ID. Simply add it to the Wallet app and use it to show proof of age or identity. DeFi wallet app MetaMask is advising users to disable iCloud backups in order to prevent potential phishing scams. Your Arizona ID in Apple Wallet - FAQs · Log onto iCloud and use the Find My app to 'pause' or deactivate your ID in Apple Wallet on iPhone and Apple Watch. 90 million songs. AppleTVAPPIcon. Discover your new favourite show. Logos/Apple-Arcade. Over incredibly fun games. iCloud/iCloud-icon. You can have up to 8 cards on a device (iCloud account required). You can have the same eight cards on an iPhone, iPad and Apple Watch, or different eight. Keys in Apple Wallet reside in your Apple device within the Apple Wallet app. To remedy this, go to Settings on your iPhone and enter your iCloud password or. Once a card is added to Apple Wallet, the physical card will no longer work. Please visit Apple ID Support or iCloud Support for more information. An iPhone 7 or later. · A device that's signed into iCloud. · A device with a passcode. · A credit or debit card from a bank account that supports Apple Pay. · A. Apple's digital wallet - Apple Pay¹ That means you can use PayPal to buy from the App Store, Apple Books or iTunes, or to buy Apple iCloud storage. Hi Holly,If you don't see the option to add a card, ticket, or other service to Wallet, contact the merchant to make sure that they support Wallet passes. I. wallet recovery shares with iCloud! This is a big step towards enabling users to recover embedded wallets independent of Privy being online. What will happen to my cards in Wallet if I turn off my iCloud? When you sign out of iCloud all of your cards will be deleted and you will need to set them up.