zagoroddom40.ru

Gainers & Losers

401k Collateral Loan

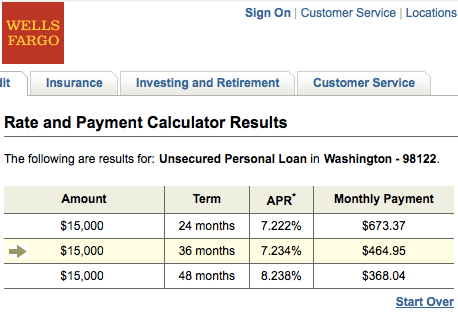

A (k) loan allows you to borrow from the balance you've built up in your retirement account. Generally, if allowed by the plan, you may borrow up to 50%. Loan Underwriting, Collateral, and Closing Considerations · B, Texas (k) accounts. Secured Loans as Debt. When qualifying the borrower, the. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). In effect, you actually use your own retirement savings as collateral for the loan. If you cannot repay the loan then the loan is viewed as a premature. You can take a loan against a k. However, you cannot invest money in to the k manually it is done through payroll deductions. You can secure the loan by pledging something with significant value in case you default – this is called collateral. An unsecured loan is when you borrow money. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans. Using your securities to borrow money. You can use securities as collateral for a loan. Here's what you need to know. Fidelity Learn. The Internal Revenue Service (IRS) does not allow (k) participants to use their retirement accounts as collateral for a loan. A (k) loan allows you to borrow from the balance you've built up in your retirement account. Generally, if allowed by the plan, you may borrow up to 50%. Loan Underwriting, Collateral, and Closing Considerations · B, Texas (k) accounts. Secured Loans as Debt. When qualifying the borrower, the. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). In effect, you actually use your own retirement savings as collateral for the loan. If you cannot repay the loan then the loan is viewed as a premature. You can take a loan against a k. However, you cannot invest money in to the k manually it is done through payroll deductions. You can secure the loan by pledging something with significant value in case you default – this is called collateral. An unsecured loan is when you borrow money. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans. Using your securities to borrow money. You can use securities as collateral for a loan. Here's what you need to know. Fidelity Learn. The Internal Revenue Service (IRS) does not allow (k) participants to use their retirement accounts as collateral for a loan.

Borrowing against your assets may also come with additional risks, since the assets need to maintain a certain amount of value for the duration of your loan. ". When you borrow money from your (k), you're essentially your own lender. The loan terms are attractive. There's no credit check. You get a low interest. Securities held in a retirement account cannot be used as collateral to obtain a securities-based loan. Securities in a Wells Fargo Bank Priority Credit Line or. The IRS prohibits using a (k) as collateral for a loan, but you may be able to obtain a loan directly from your plan. Using your K to borrow money can cause your account to lose value. As you pay back the loan you'll be re-buying the shares you previously sold, usually at a. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). An LMA account is a secured line of credit that uses your eligible securities, such as stocks and bonds, as collateral. There are no fees to establish, no. Taking a (k) loan means borrowing money from your retirement savings account. You can usually borrow up to $50,, which must be repaid. A secured personal loan is a loan where you are required to provide collateral, such as a title to an ATV, jet ski, snow mobile, tractor; or a KeyBank CD or. Whether you're taking the loan out as startup financing or paying for a big purchase, make sure to check your plan's details. If there's a loan provision in. A (k) account cannot be pledged as collateral, other than as security for certain loans from the plan. Any legitimate lender would know this. How does a (k) loan work? With most loans, you borrow money from a lender with the agreement that you will pay back the funds, usually with interest, over a. With a securities-based line of credit, Fidelity makes it simple to use your accounts as collateral to access cash for real estate, tuition or other major. The current prime rate is %, so your (k) loan rate would be from % to %. Your credit score doesn't affect the interest rate, which is one reason. (k) loan rules · Loan amounts: You can borrow 50% or up to $50, of your vested account balance. · Repayment: In most cases, you must repay the loan in. What is the Difference Between a Personal Loan and a (k) Loan? · Fixed interest rate and set regular monthly payment · Because a personal loan is unsecured. As the loan is repaid, the collateral account balance is decreased by the amount of principal repaid. The principal and interest paid are deposited into. Second lien Home equity lines are only available with an eligible first lien Schwab invested loan. Loans are subject to credit and collateral approval. Then the actual amount you'll receive is $9, If you're eligible for a Collateralized Loan: The minimum loan amount is $1, or an amount specified by your. An LMA account is a secured line of credit that uses your eligible securities, such as stocks and bonds, as collateral. There are no fees to establish, no.

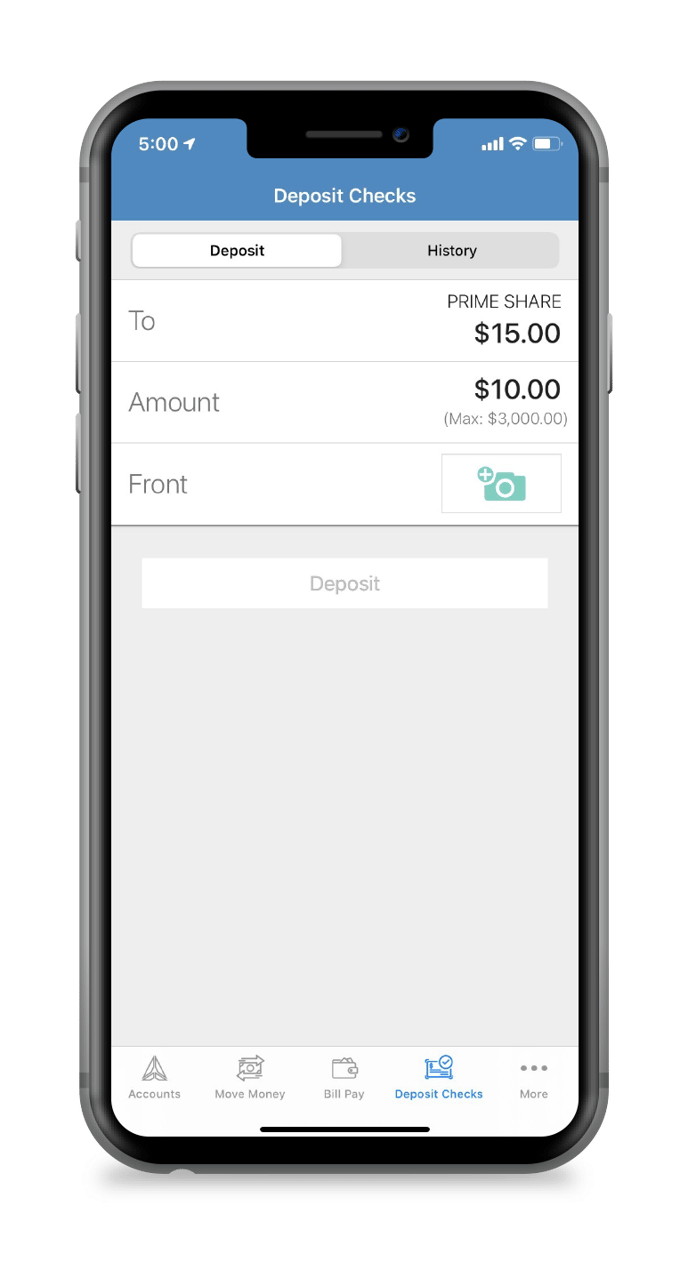

How To Deposit Check With Mobile App

Tips for using Mobile Check Deposit · Make sure you are taking a picture of check in a well-lit area. · Sign the check and write “SmartBank Mobile Deposit”. What is mobile check deposit and how does it work? · Select Transfer & pay, then choose Deposit a check. · Select the account you'd like to deposit funds into. Download your financial institution's app. · Understand your bank or credit union's policies. · Endorse the check properly. · Take photos of the front and back of. What is mobile check deposit and how does it work? · Select Transfer & pay, then choose Deposit a check. · Select the account you'd like to deposit funds into. Mobile Deposit is an easy and convenient way to deposit checks · Select “Deposit” from the main menu within Mobile Banking. · Select “Deposit a Check” · Select the. It's as easy as sign, snap and send! · Log in to the Busey - Mobile app · In the "Deposit check" portion of the dashboard, select "Make a deposit" · Enter the. Sign your check. Open the app and select Deposit a check from the quick-action menu at the bottom of the Welcome screen, then select Deposit a check again. Here's how to deposit checks in the app · Open the app and select "Transact" at the bottom of the screen. · Select "Deposit Checks" and agree to the terms of use. Step 1. Open the Mobile Banking app and select Deposit Checks. Bank of America Mobile Banking welcome screen shown. Tips for using Mobile Check Deposit · Make sure you are taking a picture of check in a well-lit area. · Sign the check and write “SmartBank Mobile Deposit”. What is mobile check deposit and how does it work? · Select Transfer & pay, then choose Deposit a check. · Select the account you'd like to deposit funds into. Download your financial institution's app. · Understand your bank or credit union's policies. · Endorse the check properly. · Take photos of the front and back of. What is mobile check deposit and how does it work? · Select Transfer & pay, then choose Deposit a check. · Select the account you'd like to deposit funds into. Mobile Deposit is an easy and convenient way to deposit checks · Select “Deposit” from the main menu within Mobile Banking. · Select “Deposit a Check” · Select the. It's as easy as sign, snap and send! · Log in to the Busey - Mobile app · In the "Deposit check" portion of the dashboard, select "Make a deposit" · Enter the. Sign your check. Open the app and select Deposit a check from the quick-action menu at the bottom of the Welcome screen, then select Deposit a check again. Here's how to deposit checks in the app · Open the app and select "Transact" at the bottom of the screen. · Select "Deposit Checks" and agree to the terms of use. Step 1. Open the Mobile Banking app and select Deposit Checks. Bank of America Mobile Banking welcome screen shown.

How to get started · Choose mobile deposit and select the account for the deposit. · Endorse your check and write “For Mobile Deposit Only” below your signature. When you log in to Hills Bank Online via your app, click "Menu" followed by "Deposit A Check." You will see options titled Deposit A Check and Enrollment. Mobile Deposit, lets you deposit checks directly from your smart phone. Simply enroll in this service and upon approval, it will automatically be added to your. Click on “deposit” next to the camera icon. Take photos of the front and back of your check (please write "for Capital One mobile deposit" and sign your name on. Mobile Check Deposit allows you to deposit checks directly into your account simply by taking a picture of the check with your Apple or Android smartphone. Using Mobile Check Deposit is easy. Select the deposit account, enter the check amount, take a picture of the front/back of the check and submit your. Mobile Check Deposit · From the Account Summary screen, select Move Money, then Deposit Checks. · Select Deposit To and choose the account. · Enter the deposit. Accounts have a $5, per check, per day limit. Who is eligible for Mobile Check Deposit? Members with an account in good standing are eligible for Mobile. How to deposit a check with Citizens Mobile Deposit · Open the latest version of the Citizens Mobile Banking app and tap Deposit. · Enter the amount of your. With Tompkins mobile check deposit, you can deposit checks from anywhere. Make banking easier in PA and NY by downloading our mobile banking app today. Easy as Tap. Snap. Deposit. · Tap. Tap “Deposit Checks” from the mobile app home screen. · Snap. Snap a picture of the front and back or your endorsed check. Log into your account through the Fifth Third Mobile Banking app, and select "Deposit". · Click "New Deposit". · Verify the account you want the check to be. With mobile check deposit, instead of using a bank teller, you upload an image of your check using a mobile app (after you've downloaded the app). You can. If you submit a check written from an Old National account through Mobile Deposit by the 8pm cut-off time, Monday through Friday (excluding holidays), the. From the mobile app, click “Check Deposit" and follow the prompts. What are my mobile deposit limits? You have a $30, deposit maximum per rolling Mobile deposit is available only on the Wells Fargo Mobile app. If you are using the mobile browser, this feature will not be available. Check to see if any. How to cash a check using PayPal? · Tap Wallet. · Tap Cash a check. · Enter the check amount, take a picture of the front and back of your endorsed check with. How It Works · Deposit your check through the PNC Mobile app, at a PNC DepositEasy ATM or with a teller. · Choose standard funds availability or PNC Express. Mobile Check Deposit. Once you have our Mobile App downloaded on to your smartphone, you can start depositing checks to your personal bank account! Open the. Launch the Mobile App, sign in, and select “Deposits”. Select the account where you wish to deposit your check. Enter the amount of the check. Take a.

Best Rv Insurance In Texas

Call today to speak with one of our licensed Good Sam Insurance Agents at INSURANCE. RV Insurance · Auto Insurance · Home Insurance. Specialized RV coverage with all the extras. On the back roads of Texas, traveling cross-country, or simply living the good life on the road—no matter how. For my new TT in Texas, Progressive with the USAA discount was half the price of anyone else with a good chunk of extra coverage since the price. Freedom Insurance Group is proud to work with 25+ top-rated insurance brands that help protect RV owners all over Texas. We compare your rate among a variety of. RV Insurers. Several insurance companies offer RV insurance, in addition to on-line quotes. Check insurance companies such as Progressive, GMAC or Geico. There. We can help you find the right RV coverage for a great price. We'll walk you through each step including making sure you get any savings or discounts you. The Good Sam Insurance Agency is a specialty RV Insurance company that also excels at Auto and Home insurance. Call for a free quote today. COVER YOUR ADVENTURE Protect your RV or recreation vehicle with the best RV insurance in Texas courtesy of Al Boenker. Get a Quote. The agents at Costlow Insurance can provide you with the RV insurance options you deserve. Visit our website for policy info & more. Call today to speak with one of our licensed Good Sam Insurance Agents at INSURANCE. RV Insurance · Auto Insurance · Home Insurance. Specialized RV coverage with all the extras. On the back roads of Texas, traveling cross-country, or simply living the good life on the road—no matter how. For my new TT in Texas, Progressive with the USAA discount was half the price of anyone else with a good chunk of extra coverage since the price. Freedom Insurance Group is proud to work with 25+ top-rated insurance brands that help protect RV owners all over Texas. We compare your rate among a variety of. RV Insurers. Several insurance companies offer RV insurance, in addition to on-line quotes. Check insurance companies such as Progressive, GMAC or Geico. There. We can help you find the right RV coverage for a great price. We'll walk you through each step including making sure you get any savings or discounts you. The Good Sam Insurance Agency is a specialty RV Insurance company that also excels at Auto and Home insurance. Call for a free quote today. COVER YOUR ADVENTURE Protect your RV or recreation vehicle with the best RV insurance in Texas courtesy of Al Boenker. Get a Quote. The agents at Costlow Insurance can provide you with the RV insurance options you deserve. Visit our website for policy info & more.

Texas drivers trust Lone Star Insurance Agency with all of their motor vehicle insurance needs, and we're here to help you get the ideal RV policy. Just contact. Protect your RV adventures with Braly Insurance Group. Offering comprehensive coverage for Texas RV owners to safeguard against accidents, theft, and more. With Coach-Net's RV roadside assistance and suite of RV solutions you coverage – owing a loan balance even after the insurance settlement. Asset. Before renting an RV, you need to protect yourself with Great insurance. You can get RV Rental Insurance from RVnGO when you rent. Progressive is our top choice for RV insurance based on analysis of its offerings and the competition. Progressive insures a wide range of RVs including Class A. No, RV insurance is not required in Texas. However, it is a good idea to have insurance on your RV if you plan on using it. This will protect you financially if. RV owners in Texas can work with Texas Classic Insurance in Granbury, TX to find the right amount of RV insurance coverage to fit their needs. We list an array of top producing insurance companies in the state of Texas so that you have plenty of choices. At Topper's RVs, Texas residents can get the very best protection for their campers against things like physical damage, major repairs many years after factory. Roamly (Preferred); Progressive (Best overall); Geico (Best customer service); Nationwide Mutual (offers the best RV insurance for full. Which insurance carriers offer travel trailer insurance? Progressive is the top carrier that we work with for travel trailer insurance at TGS! We also. We offer coverage for all of your recreational vehicle needs, campers, boats, trailers, and more. Let us design the coverage, and you take care of the fun. Choose travel/camping trailer insurance if what's to be insured is towed, or can't be driven on its own. What sets State Farm RV Insurance apart? 19, agents. If you own an RV in Texas, you can work with Granbury TX based All-Tex Insurance to find the right amount of RV insurance coverage to fit your needs. Call today to speak with one of our licensed Good Sam Insurance Agents at INSURANCE. RV Insurance · Auto Insurance · Home Insurance. USAA offers RV insurance for your motorhome, travel trailer, camper and fifth wheel. Learn more about RV insurance costs, rates and coverage. America's RV Warranty offers coverage for every vehicle and budget in Texas. Unexpected breakdowns can ruin your vacation plans and your bank account. CALL THE TEXAS RV INSURANCE HOTLINE: () FOR MORE INFORMATION. Before you ever get on the road, you need Texas RV insurance. Certain policies are. Our agents have helped many RV owners insure their vehicles, and we'll work with you to find the best policy for yours. We can recommend the best RV insurance.

How To Not Pay Tax On Cryptocurrency

Gains from cryptocurrency are taxable from the beginning of time. There is no specific exemption provided in the Income Tax Law. Further, the. This means that, in HMRC's view, profits or gains from buying and selling cryptoassets are taxable. This page does not aim to explain how cryptoassets work. If you're holding crypto, there's no immediate gain or loss, so the crypto is not taxed. Tax is only incurred when you sell the asset, and you subsequently. Where income is gained from cryptocurrencies before the duty to deduct capital gains tax comes into force, and if the tax is not deducted voluntarily, the. ZenLedger is a leading cryptocurrency tax platform that has been helping its users save money and be IRS compliant since With ZenLedger, you can not only. Do I owe capital gains tax on a sale of cryptocurrency? You How can I claim a refund of my estimated payment if I have determined I do not owe tax? If you earn less than $44, including your crypto (for the tax year) then you'll pay no long-term Capital Gains Tax at all. It's important to note that. Tax refunds will not be issued in crypto currencies. How to Make a Payment using Cryptocurrency: Begin by accessing Revenue Online. You do not need to log in to. The following are not taxable events according to the IRS Buying cryptocurrency with fiat money; Donating cryptocurrency to a tax-exempt non-profit or. Gains from cryptocurrency are taxable from the beginning of time. There is no specific exemption provided in the Income Tax Law. Further, the. This means that, in HMRC's view, profits or gains from buying and selling cryptoassets are taxable. This page does not aim to explain how cryptoassets work. If you're holding crypto, there's no immediate gain or loss, so the crypto is not taxed. Tax is only incurred when you sell the asset, and you subsequently. Where income is gained from cryptocurrencies before the duty to deduct capital gains tax comes into force, and if the tax is not deducted voluntarily, the. ZenLedger is a leading cryptocurrency tax platform that has been helping its users save money and be IRS compliant since With ZenLedger, you can not only. Do I owe capital gains tax on a sale of cryptocurrency? You How can I claim a refund of my estimated payment if I have determined I do not owe tax? If you earn less than $44, including your crypto (for the tax year) then you'll pay no long-term Capital Gains Tax at all. It's important to note that. Tax refunds will not be issued in crypto currencies. How to Make a Payment using Cryptocurrency: Begin by accessing Revenue Online. You do not need to log in to. The following are not taxable events according to the IRS Buying cryptocurrency with fiat money; Donating cryptocurrency to a tax-exempt non-profit or.

You're required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law. 2. Donations using crypto are tax-free If you donate to a charity that accepts crypto, you can claim your contribution on your tax return and offset any. Natural persons must declare the income from trading in cryptocurrency, as well as the income from the conversion of cryptocurrency into regular (fiat). Natural persons must declare the income from trading in cryptocurrency, as well as the income from the conversion of cryptocurrency into regular (fiat). You can reduce your crypto taxes by selling your crypto after 12 months of holding it, entering a favorable long-term capital gains tax setting. 2. Take a. Just like other kinds of crypto, you need to pay tax on any profits you make when selling Bitcoin. The tax rate depends on how long you held the Bitcoin before. If virtual currency is received as a bona fide gift, no income is recognized until you sell, exchange or otherwise dispose of that virtual currency. Your basis. The IRS is perfectly clear crypto is taxed and failure to report crypto on your taxes may result in steep penalties. At tax time, you'll fold these gains into your regular income, then pay taxes on everything together at your ordinary income tax rate. Note: Those with incomes. Tax fraud charges resulting from failure to pay taxes on cryptocurrency earnings are charged under federal tax evasion law. , explaining that virtual currency is treated as property for federal income tax purposes and providing examples of how longstanding tax principles. Donate or gift your crypto. Donations could actively reduce your tax bill, while gifting could help you avoid paying taxes on gains. Gifting crypto is generally. While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade it for another cryptocurrency. Not to mention. Yes, converting Bitcoin to Ethereum is a taxable event and must be reported. Pioneering digital asset accounting teams use Bitwave. Schedule a Demo. There are various ways to reduce or even avoid crypto taxes completely. In this guide, we explain how to avoid crypto taxes legally, covering eight effective. If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%. In general, crypto swaps are subject to taxation, but in the case of a crypto swap loss, there is simply no income (also referred to as a capital gain) for the. Therefore, no special tax rules for crypto-asset transactions are required. declare the gain to Revenue by filing a tax return and pay any CGT arising. And therefor, subject to capital gains tax. Does this TAX have to be paid despite not converting the final transaction to legal currency? As in, just left on-. When you dispose of your crypto by trading, exchanging, or spending it, you'll need to report these transactions on Form , Schedule D. You may also need to.

8x8 Inc Stock

8X8 Inc. ; YTD Change. % ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Volume, M. 8x8 Inc provides contact-center-as-a-service and unified-communications-as-a-service software applications to approximately million users. 8x8 Inc EGHT:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date12/28/23 · 52 Week Low · 52 Week Low Date. The share stock price for EGHT stock is $ as of 8/2/ What is the week high for 8x8 Inc (EGHT)? The. 8x8 Inc Common Stock Performance ; Diluted EPS (TTM), ; Revenue Growth YOY, ; Earnings Growth YOY, 0 ; Profit margin, US$ That's What Analysts Think 8x8, Inc. (NASDAQ:EGHT) Is Worth After Its Latest Results · Simply Wall St. · 10 hours ago ; Why 8x8 (EGHT) Shares Are Trading. The current price of EGHT is USD — it has decreased by −% in the past 24 hours. Watch 8x8 Inc stock price performance more closely on the chart. EGHT Stock Overview · Rewards · Risk Analysis · 8x8, Inc. Competitors · Price History & Performance · Recent News & Updates · Consensus EPS estimates fall by 17%. 8X8 Inc (EGHT) has a Smart Score of 2 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity. 8X8 Inc. ; YTD Change. % ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Volume, M. 8x8 Inc provides contact-center-as-a-service and unified-communications-as-a-service software applications to approximately million users. 8x8 Inc EGHT:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date12/28/23 · 52 Week Low · 52 Week Low Date. The share stock price for EGHT stock is $ as of 8/2/ What is the week high for 8x8 Inc (EGHT)? The. 8x8 Inc Common Stock Performance ; Diluted EPS (TTM), ; Revenue Growth YOY, ; Earnings Growth YOY, 0 ; Profit margin, US$ That's What Analysts Think 8x8, Inc. (NASDAQ:EGHT) Is Worth After Its Latest Results · Simply Wall St. · 10 hours ago ; Why 8x8 (EGHT) Shares Are Trading. The current price of EGHT is USD — it has decreased by −% in the past 24 hours. Watch 8x8 Inc stock price performance more closely on the chart. EGHT Stock Overview · Rewards · Risk Analysis · 8x8, Inc. Competitors · Price History & Performance · Recent News & Updates · Consensus EPS estimates fall by 17%. 8X8 Inc (EGHT) has a Smart Score of 2 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.

Stock Price Forecast. The 6 analysts with month price forecasts for 8x8, Inc. stock have an average target of , with a low estimate of and a high. Porch Group Inc. $ PRCH ; Five9 Inc. $ FIVN ; Lumen Technologies Inc. $ LUMN ; Meridianlink Inc. $ MLNK ; Amplitude Inc. $ AMPL. 8x8 Inc is listed in the Cmp Processing,data Prep Svc sector of the NASDAQ with ticker EGHT. The last closing price for 8x8 was $ Over the last year, 8x8. 8x8, Inc. provides voice, video, chat, contact center, and enterprise-class application programmable interface (API) Software-as-a-Service solutions. Stock Quote & Chart. Stock Quote. NASDAQ GS: EGHT. $ Aug 30, PM EDT. Change. 0 (%). Volume. , Today's Open. $ Previous Close. 8X8 Inc is a publicly traded company listed under the ticker symbol 8X8 Inc. Online trading platforms provides real-time stock price updates and charts. ; Short Term ; Industry, Software - Application (US), Mixed ; Software - Application (Global), Mixed ; Stock, 8x8 Inc, Bullish. What is 8x8, Inc. (EGHT)'s stock price history? Over the last year, 8x8, Inc.'s stock price has decreased by %. 8x8, Inc. is currently approximately $ 8x8 (EGHT) Stock Soars on Earnings Beat. 8x8 (EGHT) stock is advancing in mid-morning trading on Friday after the company reported its fiscal third quarter. 8x8 Inc. offers VoIP products, including cloud-based voice, contact center, video, mobile and unified. The latest closing stock price for 8x8 Inc as of September 05, is The all-time high 8x8 Inc stock closing price was on January 25, The. What Is the 8x8 Inc Stock Price Today? The 8x8 Inc stock price today is What Is the Stock Symbol for 8x8 Inc? The stock ticker symbol for 8x8 Inc is EGHT. 8X8 Inc Stock forecast & analyst price target predictions based on 10 analysts offering months price targets for EGHT in the last 3 months. See the latest 8x8 Inc stock price (EGHT:XNAS), related news, valuation, dividends and more to help you make your investing decisions. 8x8, Inc. (zagoroddom40.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock 8x8, Inc. | Nasdaq: EGHT | Nasdaq. 8X8 Inc. · AFTER HOURS PM EDT 08/30/24 · % · AFTER HOURS Vol 5, Can Indians buy 8x8 Inc shares? Yes, Indians can invest in the 8x8 Inc (EGHT) from India. With INDmoney, you can buy 8x8 Inc at 0 brokerage. The step-by-step. Track 8X8 Inc. (EGHT) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. Stock analysis for 8x8 Inc (EGHT:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. 8X8 Inc. ; Jun PM · 8x8, Inc. Appoints Andrew Burton to Board of Directors. (Business Wire) % +% ; Jun AM · Why 8x8 (EGHT) Shares.

Lender Paid Mortgage Insurance Calculator

Mortgage insurance or private mortgage insurance (PMI) is common with many mortgages and is paid by the homeowner. It protects your lender in the event that. During a refinance, the borrower usually books a new loan to pay off the existing mortgage to take advantage of a drop in interest rates. However, you can. The calculations above are based on details you have entered into the calculator tool and are for illustrative purposes only and accuracy is not guaranteed. Enjoy the ease and convenience of one loan and one low payment. · What is Lender Paid Mortgage Insurance (LPMI)? · Related Blog Posts. pay mortgage insurance premiums, which are also added to your monthly payment. loan to request that your lender remove private mortgage insurance (PMI). The Conventional with LPMI (Lender Paid Private Mortgage Insurance) is for the borrower that has at least 5% to put towards a down payment but less than 20%. This Private Mortgage Insurance (PMI) calculator reveals monthly PMI costs, the date the PMI policy will cancel and produces an amortization schedule for. paid to the lender for using the money. There may be an escrow account involved to cover the cost of property taxes and insurance. The buyer cannot be. Use our CMHC mortgage calculator to calculate your CMHC fees and mortgage default insurance. Enter the asking price, downpayment and amortization period. Mortgage insurance or private mortgage insurance (PMI) is common with many mortgages and is paid by the homeowner. It protects your lender in the event that. During a refinance, the borrower usually books a new loan to pay off the existing mortgage to take advantage of a drop in interest rates. However, you can. The calculations above are based on details you have entered into the calculator tool and are for illustrative purposes only and accuracy is not guaranteed. Enjoy the ease and convenience of one loan and one low payment. · What is Lender Paid Mortgage Insurance (LPMI)? · Related Blog Posts. pay mortgage insurance premiums, which are also added to your monthly payment. loan to request that your lender remove private mortgage insurance (PMI). The Conventional with LPMI (Lender Paid Private Mortgage Insurance) is for the borrower that has at least 5% to put towards a down payment but less than 20%. This Private Mortgage Insurance (PMI) calculator reveals monthly PMI costs, the date the PMI policy will cancel and produces an amortization schedule for. paid to the lender for using the money. There may be an escrow account involved to cover the cost of property taxes and insurance. The buyer cannot be. Use our CMHC mortgage calculator to calculate your CMHC fees and mortgage default insurance. Enter the asking price, downpayment and amortization period.

Private mortgage insurance is insurance for your mortgage. You pay a PMI guarantees that the lender gets paid if the borrower defaults on the loan. Lender Paid Mortgage Insurance. We can save you some serious money on your monthly payments. Get a home loan with only 5%% down. Low interest rates. Mortgage loan insurance protects the lender. On the other hand, mortgage protection insurance pays off the balance of the mortgage should one of the borrowers. PMI is the lender's protection against the borrower defaulting on the loan. It allows lenders to offer financing with lower down payments at reasonable rates. Mortgage default insurance (CMHC) is mandatory in Canada for down payments between 5% and %. Use our calculator to determine how much CMHC insurance. PMI is the lender's protection against the borrower defaulting on the loan. It allows lenders to offer financing with lower down payments at reasonable rates. PMI: Property mortgage insurance policies insure the lender gets paid if the borrower does not repay the loan. PMI is only required on conventional. This calculator compares the total cost of borrower-pay mortgage insurance, lender-pay mortgage insurance, and a piggyback second mortgage. Down Payment Calculator. Explore how much money you should put down on your home. Private Mortgage Insurance (PMI) Calculator. Find your monthly private. Use our mortgage calculator to calculate monthly payment along with Taxes, Insurance, PMI, HOA & Extra Payments on your home mortgage loan in the U.S. mortgage payment including and estimated amount for Private Mortgage Insurance (PMI) NMLS #, MA Mortgage Broker License #MC, MA Mortgage Lender. Premiums are paid by lender · Mortgage Insurance specifics not disclosed to borrower · Lender Paid premiums are non-refundable · Not cancellable by the borrower. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. The 28/36 percent rule is a general guideline for potential homebuyers to follow. It is recommended that your monthly mortgage payment (including taxes and. Your lender collects this fee because the county can seize a home if property taxes are not paid. The calculator estimates property taxes based on averages from. pay mortgage insurance premiums, which are also added to your monthly payment. loan to request that your lender remove private mortgage insurance (PMI). Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. This Federal Housing Administration (FHA) mortgage insurance premium (MIP) calculator accurately displays the cost of mortgage insurance for an FHA-backed loan. Calculate payments. Enter your home price, down payment, ZIP code and credit score into our calculator Footnote(Opens Overlay) to see which mortgage option may.

What Is Wells Fargo Savings Account Interest Rate

A total amount of $25 or more of automatic transfersFootnote 1 from a Wells Fargo business checking account into this savings account interest rate for a. The national average annual percentage yield for savings accounts is %. Top Savings Account Interest Rates. UFB Portfolio Savings logo. UFB Portfolio. Wells Fargo Way2Save® Savings interest rate ; Balance. $0 or more ; Standard Interest Rate. % ; Annual Percentage Yield (APY). %. It offers fixed interest rates with flexible terms, along with the security of FDIC insurance. Compare. Find out which savings account is right for your. Wells Fargo Bank standard CD features ; Minimum opening deposit, $2, ; Early withdrawal penalty (less than 90 days), 1 month's interest ; Early withdrawal. $ checking bonus on us · Earn a $ cash rewards bonus · Want a $ checking bonus? · Open a savings account · Interest rates today · Earn up to 90, bonus. Compare our savings account rates to find the best savings account or CD account to reach your future savings goals. Wells Fargo offers four CD terms online, with rates ranging from % to % APY – all require a minimum opening deposit of $2, to $5, Higher “. Wells Fargo Savings Accounts: Key Features ; $0–$99, · % ; $,–$, · % ; $,–$, · % ; $1,, or more · %1. A total amount of $25 or more of automatic transfersFootnote 1 from a Wells Fargo business checking account into this savings account interest rate for a. The national average annual percentage yield for savings accounts is %. Top Savings Account Interest Rates. UFB Portfolio Savings logo. UFB Portfolio. Wells Fargo Way2Save® Savings interest rate ; Balance. $0 or more ; Standard Interest Rate. % ; Annual Percentage Yield (APY). %. It offers fixed interest rates with flexible terms, along with the security of FDIC insurance. Compare. Find out which savings account is right for your. Wells Fargo Bank standard CD features ; Minimum opening deposit, $2, ; Early withdrawal penalty (less than 90 days), 1 month's interest ; Early withdrawal. $ checking bonus on us · Earn a $ cash rewards bonus · Want a $ checking bonus? · Open a savings account · Interest rates today · Earn up to 90, bonus. Compare our savings account rates to find the best savings account or CD account to reach your future savings goals. Wells Fargo offers four CD terms online, with rates ranging from % to % APY – all require a minimum opening deposit of $2, to $5, Higher “. Wells Fargo Savings Accounts: Key Features ; $0–$99, · % ; $,–$, · % ; $,–$, · % ; $1,, or more · %1.

Wells Fargo's Business Market Rate savings account combines liquidity with competitive rates to suit the growing balances of your business. A Platinum Savings account offers rate tiers, with higher rates going to bigger balances, but rates still top out at % APY for balances of $1 million or. PNC savings account - Standard Savings Account with an APY of %. High-yield savings accounts. High-yield savings accounts offer a much higher interest rate. Annual Percentage Yield (APY). Visit a branch to earn a % Promotional Interest Rate with % - % Annual Percentage Yield. · Minimum balance. None. On the Way2Save Savings account, you earn an APY of %. On the Platinum Savings account, you can earn a %. The % APY on Well Fargo's seven-month Special Fixed Rate CD term, not including any boost for also owning an eligible checking account, is a great offer. The APY is % (variable) for balances of up to $99,, but it goes up to % based on your balance. Like the Way2Save account, Platinum Savings has a. Wells Fargo was having for a % rate for 12 months for a Watch your account's interest rates people. Banks are messing with. Wells Fargo's Platinum Savings Account offers higher interest rates for larger balances and the security of an FDIC-insured account. Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the Bank at any time. Fees could reduce earnings. The balance. Learn how to open a Wells Fargo Destination® IRA (FDIC-Insured CDs and Savings Accounts). Compare interest rates across business savings options; Learn more about what you'll need to open a business account; Take advantage of hour account access. Standard Interest Rate CDs require a $2, minimum opening deposit, unless otherwise noted. · 3 ways to fund your account: · (a) Transfer from an existing Wells. Wells Fargo savings account features · Monthly service fee: $12 · Standard interest rate: % to % (compounded daily and paid monthly) · APY: % to %. Interest Rate to be applied to your eligible savings account. CDs must be linked at account open and/or at every renewal. If the checking account is closed. Wells Fargo CD rates ; Special Fixed Rate CD, 7 months, %*, $5, ; Special Fixed Rate CD, 11 months, %*, $5, The Expanded Bank Deposit Sweep consists of interest-bearing deposit accounts at up to five banks including affiliated and unaffiliated banks. If your account. Wells Fargo offers two kinds of savings accounts: Way2Save Savings and Platinum Savings. Here's a look at their savings rates and features. The Deposit Account Agreement,. • Our interest rate sheet for interest-bearing accounts,. • Our privacy notice, and. • Any additional disclosures, amendments.

Institutional Investor Examples

Institutional investors are considered as an organisation or company that invests money on behalf of other people. Examples of institutional investors are. Examples of institutional investors include pension funds, insurance aligns well to institutional investor preferences to match long-term investments. Investment banks, insurance companies, and mutual funds are examples of institutional investors. Institutional investors may be able to purchase securities. Examples of institutional investors include pension funds, mutual funds, insurance companies, endowments, and hedge funds. The following are some of the. Institutional investors are any organizations or persons which collect quite number sums of money to invest in securities and also control a collection of. Firms like insurance firms, banks, mutual funds, pension funds, and hedge funds are examples of institutional investors. Institutional investors hugely affect. Some widely known types of institutional investors include pension funds, banks, mutual funds, hedge funds, endowments, and insurance companies. On the other. Examples include insurance firms, mutual funds, and pension plans. The whales on Wall Street are institutional investors because they frequently buy and sell. Summary · The main institutional investor types are pension plans, sovereign wealth funds, endowments, foundations, banks, and insurance companies. Institutional investors are considered as an organisation or company that invests money on behalf of other people. Examples of institutional investors are. Examples of institutional investors include pension funds, insurance aligns well to institutional investor preferences to match long-term investments. Investment banks, insurance companies, and mutual funds are examples of institutional investors. Institutional investors may be able to purchase securities. Examples of institutional investors include pension funds, mutual funds, insurance companies, endowments, and hedge funds. The following are some of the. Institutional investors are any organizations or persons which collect quite number sums of money to invest in securities and also control a collection of. Firms like insurance firms, banks, mutual funds, pension funds, and hedge funds are examples of institutional investors. Institutional investors hugely affect. Some widely known types of institutional investors include pension funds, banks, mutual funds, hedge funds, endowments, and insurance companies. On the other. Examples include insurance firms, mutual funds, and pension plans. The whales on Wall Street are institutional investors because they frequently buy and sell. Summary · The main institutional investor types are pension plans, sovereign wealth funds, endowments, foundations, banks, and insurance companies.

An institutional investor is a startup that invests money on behalf of other individuals. Institutional investors are often known to buy and sell high-level. An institutional investor is a type of organization that manages investments on behalf of their clients. Examples of institutional investors include. For example, a portion of many people's paychecks is given to a pension fund each month. The pension fund uses the money to buy other financial assets to earn a. An investment management company with a purpose in helping our institutional clients succeed with mutual funds, k plans, target date funds and more. Pension funds, mutual funds, banks, hedge funds, endowments, and insurance companies are examples of well-known institutional investors. Retail investors are. Fundamentally, institutional investors are the organisations of experts who control vast sums of capital, and use their expertise to make strategic investments. Pension funds, insurance companies, mutual funds, hedge funds, endowments and foundations, and sovereign wealth funds are all examples of institutional. They function as highly specialized investors on behalf of others. To cite an example, the pension that an employee is entitled to receive from his employer is. Obvious examples of institutional investors include superannuation funds and managed funds. For the purposes of this report, institutional investors. Mutual funds; Hedge funds; Pension funds; Banks & credit unions; Insurance companies; Investment advisers. In each of these examples, a large pool of capital. An institutional investor is a large organization such as a pension fund or insurance company that invests funds on behalf of others. An institutional investor is a company or organization that pools money to buy securities, real estate and other financial assets. Examples include pension. Institutional Investor Services · Custody Agreement and Securities Lending Agreement negotiations; · Repurchase Agreements; · Public-Private Investment Programs;. INSTITUTIONAL INVESTOR meaning: an organization, for example a bank or insurance company, that invests in something. Learn more. Institutional investors include pension funds, sovereign wealth funds, insurance companies, mutual funds, and hedge funds. These entities manage large pools of. Institutional investors are single, nonindividual entities such as limited liability companies (LLCs), limited liability partnerships (LLPs), and real estate. An institutional investor is an entity that pools and invests money on behalf of its members in stocks, bonds, real estate and other investment assets. Define Institutional Investor. means (a) any Purchaser of a Note, (b) any holder of a Note holding (together with one or more of its affiliates) more than. Institutional activism that raises a company's stock price increases the financial returns for the institution's clients. In late , for example, Hong Kong.

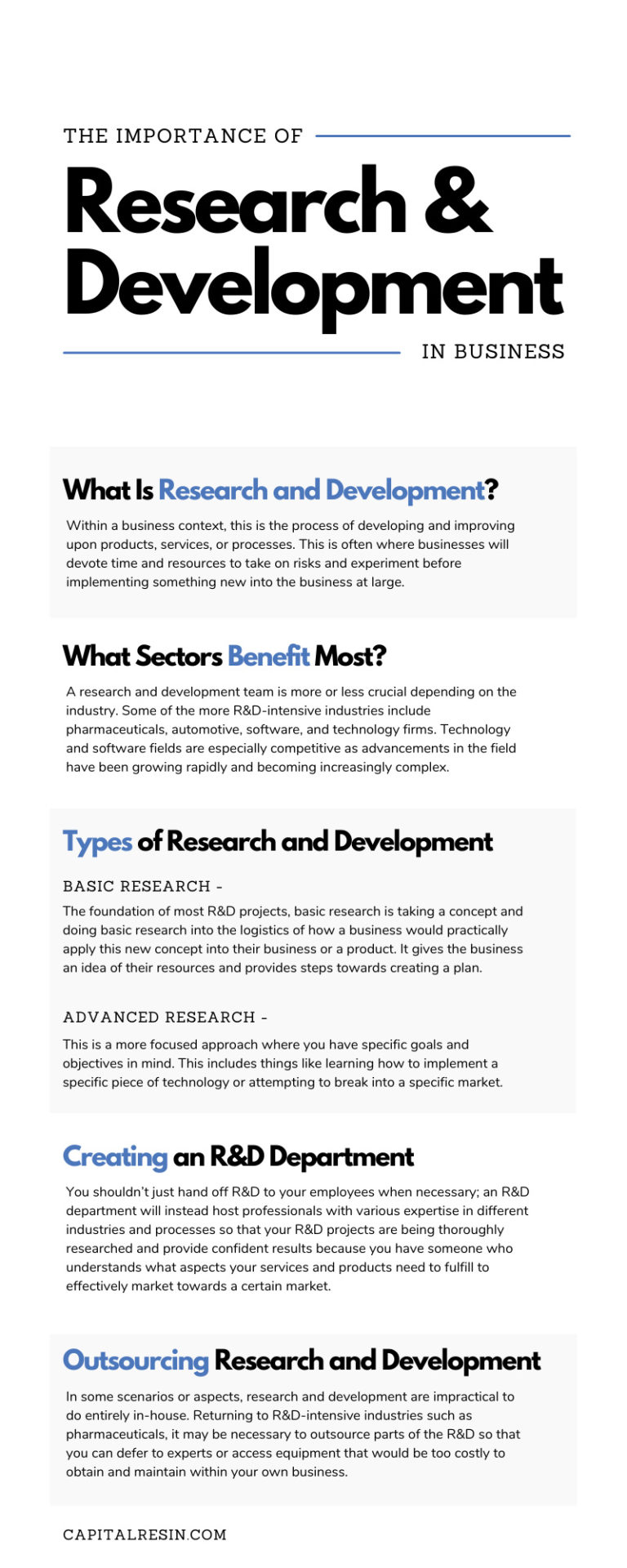

Research Of Development

The journal Research, Society and Development (abbreviated as Res. Soc. Dev.) is a multidisciplinary scientific publication focused on promoting the. How We Work. Research Development supports and promotes Northeastern's research enterprise, attracting and securing external research funding, bringing. Introduction. This publication provides definitions of research and development from several U.S. and international sources. Launched in , the program aims to nurture future leaders for the Texas A&M research enterprise by providing $75, seed grants to support faculty research. The National Education Research and Development Centers (R&D Centers) are funded through the National Center for Education Research (NCER). The mission of the. The aim of the research & development (R&D) process blade is to support innovation and the exploration of potential new or improved products and services . The term R&D covers three activities: basic research, applied research and experimental development. Basic research is experimental or theoretical work. The purpose of the CHIPS Research and Development (R&D) programs is to advance the development of semiconductor technologies and to enhance the competitiveness. What is R&D? · A systematic, intensive study directed toward greater knowledge or understanding of the subject studied; · A systematic study directed. The journal Research, Society and Development (abbreviated as Res. Soc. Dev.) is a multidisciplinary scientific publication focused on promoting the. How We Work. Research Development supports and promotes Northeastern's research enterprise, attracting and securing external research funding, bringing. Introduction. This publication provides definitions of research and development from several U.S. and international sources. Launched in , the program aims to nurture future leaders for the Texas A&M research enterprise by providing $75, seed grants to support faculty research. The National Education Research and Development Centers (R&D Centers) are funded through the National Center for Education Research (NCER). The mission of the. The aim of the research & development (R&D) process blade is to support innovation and the exploration of potential new or improved products and services . The term R&D covers three activities: basic research, applied research and experimental development. Basic research is experimental or theoretical work. The purpose of the CHIPS Research and Development (R&D) programs is to advance the development of semiconductor technologies and to enhance the competitiveness. What is R&D? · A systematic, intensive study directed toward greater knowledge or understanding of the subject studied; · A systematic study directed.

With the goal of enabling competitive individual and team research and facilitating research excellence, research development professionals build and implement. The goal of the Research & Technology Development Office is to maximize the funding success of our researchers in external research, infrastructure and. Our global R&D network. Our central research division combines expertise in areas such as chemical synthesis, process development, bioscience, catalysis. We maintain our long-term commitment to research and development across a wide spectrum of technologies, tools, and platforms. The mission of the Department of Research and Development is to Imagine, invest in and collaboratively create a sustainable, equitable, and thriving Hawaiʻi. Research & Development. Leveraging global knowledge across development, research, intellectual asset management, and scientific and regulatory affairs. The DOE Lighting R&D Program is driving innovative lighting research and development (R&D) that will redefine lighting – and related energy savings. The Institute of Development Research and Development Policy (IEE) follows an approach to research that aims at finding theory-based solutions for real-world. research studies and significant findings in child development and its related disciplines. Like all SRCD publications, Monographs enables development. Educational Technology Research and Development is a scholarly journal focusing on research and development in educational technology. Publishes rigorous. Research and development (R&D) is when businesses gather knowledge to create new products or discover new ways to improve the service they specialise in. Studies have found that every dollar invested in R&D generates nearly two dollars in return. While the rate will vary, R&D is an important driver of. Research and development approach. R&D is central to our purpose to get ahead of disease together. By combining the science of the immune system with leading. Research and experimental development (R&D) comprises creative work undertaken on a systematic basis in order to increase the stock of human knowledge and. Research and development. We're looking for the world's best talent to help us discover and develop new products. We're looking for the world's best talent to. The series Research for Development serves as a vehicle for the presentation and dissemination of complex research and multidisciplinary projects. The. The Networking and Information Technology Research and Development (NITRD) Program is the Nation's primary source of federally funded work on advanced. The Development Research Group is the World Bank's principal research department. With its cross-cutting expertise on a broad range of topics and countries. Servier's governance model headed by a non-profit foundation aligns perfectly with the long-term perspective required for research and development. Our. B.C.'s R&D Advantages · B.C. Bioenergy Network · B.C. Knowledge Development Fund · BCNET · Canadian Institute for Advanced Research · adMare BioInnovations.

Gutter Guard Cost Per Foot

In April the cost to Install a Rain Gutter Cover starts at $ - $ per linear foot. Use our Cost Calculator for cost estimate examples customized. Installed Length linear feet. Material Quality Basic - contractor grade. Labor Medium cost labor. Roof Layout* Low slope, common shape. Get an instant. $ FRO 6″ GUTTERING. SO, EITHER APX $ OR $ PER FOOT. The average cost of installing gutter guards on a standard house, with approximately linear feet of gutters, is between $ to $ Depending on the type of gutter guard you choose—and the material from which it's made—you can expect to spend between $ and $ per linear foot. For a. Median Gutter Guard Cost in Your Area. LeafFilter gutter guards cost about $30 to $40 per linear foot. The table below lays out the median costs for Wisconsin. They are typically $1 to $3 per linear foot and are often chosen by do-it-yourselfers. The issue with vinyl gutter guards, however, is that they are not durable. RAINDROP RF75 Gutter Guard for 5"-6" gutters 3 feet Black · Buy 30 for $ each and save 3% · Buy for $ each and save 6% · Buy for $ each and. How Much will new Gutters cost? · Cost for Gutter Materials ONLY? · Vinyl Gutters and Downspout Cost: $2 to $5 per Linear Foot · Aluminum Gutters and Downspout. In April the cost to Install a Rain Gutter Cover starts at $ - $ per linear foot. Use our Cost Calculator for cost estimate examples customized. Installed Length linear feet. Material Quality Basic - contractor grade. Labor Medium cost labor. Roof Layout* Low slope, common shape. Get an instant. $ FRO 6″ GUTTERING. SO, EITHER APX $ OR $ PER FOOT. The average cost of installing gutter guards on a standard house, with approximately linear feet of gutters, is between $ to $ Depending on the type of gutter guard you choose—and the material from which it's made—you can expect to spend between $ and $ per linear foot. For a. Median Gutter Guard Cost in Your Area. LeafFilter gutter guards cost about $30 to $40 per linear foot. The table below lays out the median costs for Wisconsin. They are typically $1 to $3 per linear foot and are often chosen by do-it-yourselfers. The issue with vinyl gutter guards, however, is that they are not durable. RAINDROP RF75 Gutter Guard for 5"-6" gutters 3 feet Black · Buy 30 for $ each and save 3% · Buy for $ each and save 6% · Buy for $ each and. How Much will new Gutters cost? · Cost for Gutter Materials ONLY? · Vinyl Gutters and Downspout Cost: $2 to $5 per Linear Foot · Aluminum Gutters and Downspout.

High-quality DIY gutter guards may cost approximately $4-$5 per linear foot for materials, while professional installation of more complex systems can range. Gutter Guard Prices ; GutterGlovePro 5-STARS. RESIDENTIAL & COMMERCIAL Structures #1 CHOICE starting @ $35 per foot · Lifetime Transferable Warranty on. Our gutter guard installation price is approximately $10 per lineal foot. That is for 5” K-style gutters, which is by far the most common style of gutter in our. 6'' Waterlock Gutter Guards - $ per ft · Waterlock Gutter Guards- Maintenance Free Gutter Protection for Life · Customer Reviews · You Might Also Like. Shur Flo leaf guard cost varies by home, ranging between $6 to $10 per linear foot. Aluminum Screen: Our aluminum screen gutter guards are an affordable. Prices quoted here are high. I just had my old ones removed at $/foot and new ones, materials and installed for under $7/foot. And this. Your expenses may depend on the design and quality of materials and whether you are about to hire professionals. The gutter guard installation cost per foot can. On average, professional installation costs $9 per linear foot. However, there are many factors that impact the overall price. Cost Per Foot. As previously. Hydro Flow Gutter Guards are the premier option to prevent debris from entering your gutters. It features a 2 layer integrated system. A-M Gutter Guard has holes per foot. Brief content visible, double tap They say it's a decent quality product for the price and a steal at the price. How Much will new Gutters cost? · Cost for Gutter Materials ONLY? · Vinyl Gutters and Downspout Cost: $2 to $5 per Linear Foot · Aluminum Gutters and Downspout. Depending on the type of material (brush, reverse curve, solid, foam, mesh, or micro-mesh), gutter guards can cost you between $ and $ per foot. The. They tend to cost from $4 to $14 per linear foot with an average lifespan of up to 20 years. In addition to being lightweight, aluminum gutters are rust-. New Construction Gutter Guard Pieces Per Box: 5in. - 48 Pieces; 6in. - 34 I purchased feet of the zip leaf relief TP53ZIP which is one long 10 foot box. The average price for Gutter Guards & Strainers ranges from $10 to over $5, Related Categories. Downspouts · Gutters · Gutter Fittings. According to Angie's List, the average cost of gutter guards is $ and $10 per linear foot installed. gutter guard installation, though more complex gutter. While some homeowners may consider DIY solutions, some of which can be as inexpensive as $1 per foot, it's essential to understand that with gutter guards, you. However, more options can cost less than $ per foot. Some options out there, such as some micro steel mesh guards will cost under $3. When considering the. Gutter Guard Types ; Type, Cost (Per Linear Foot), Pros, Cons ; Screen, $ $2, -Affordable-Easy to install and remove-Decent protection for the price, -. Of the companies we reviewed, only A-M Gutter Guard and Amerimax Screen offered their flagship products for less than $ per linear feet. By contrast.